IEA releases World Energy Investment 2018

17 July 2018

The International Energy Agency (IEA) released the World Energy Investment 2018 report—its latest review of global energy spending. According to the IEA analysis, global energy investment in 2017 failed to keep up with energy security and sustainability goals, raising concerns about the long-term adequacy of world’s energy supply.

For the third consecutive year, global energy investment declined, to USD 1.8 trillion in 2017—a 2% decline in real terms from the previous year. More than USD 750 billion went to the electricity sector, while USD 715 billion was spent on oil and gas supply globally. It was a second year in the row when investment in the electricity sector exceeded that in the oil and gas industry.

State-backed investments are accounting for a rising share of global energy investment—the share of energy investment driven by state-owned enterprises increased over the past five years to over 40% in 2017. Government policies are also playing a growing role in driving private spending. More than 95% of all power sector investment is now based on regulation or contracts for remuneration, with a dwindling role for new projects based solely on revenues from variable pricing in competitive wholesale markets. Investment in energy efficiency is particularly linked to government policy, often through energy performance standards.

Electricity and Renewables. The relationship between electricity demand and investment continues to evolve, with the power sector becoming more capital intensive. Over the past decade, the ratio of global power sector investment to demand growth more than doubled on average with policies to encourage renewables and efforts to upgrade and expand grids, but also due to more energy efficiency dampening demand growth.

In 2017, global power sector investment fell by 6% to near USD 750 billion, mainly the result of a 10% slump in the commissioning of new generation capacity. The share of investment in less capital-intensive thermal generation has generally declined over time. Retirements of nuclear power plants exceeded new construction starts as investment in the sector declined to its lowest level in five years in 2017. Investment in gas-fired generation capacity rose by nearly 40%, led by the United States and the Middle East/North Africa.

After several years of growth, combined global investment in renewables and energy efficiency declined by 3% in 2017 and will likely slow further this year. Investment in renewable power, which accounted for two-thirds of power generation spending, dropped 7% in 2017. Recent policy changes in China and the reduction of government subsidies for the solar industry raise the risk of a slowdown in investment this year. As China accounts for more than 40% of global investment in solar PV, its policy changes have global implications.

While energy efficiency showed some of the strongest expansion in 2017, it was not enough to offset the decline in renewables. Moreover, efficiency investment growth has weakened in the past year as policy activity showed signs of slowing down.

Though still a small part of the market, electric vehicles account for much of the growth in global passenger vehicle sales, spurred by government purchase incentives. For electric cars, 24% of the global value of EV sales in 2017 came from the budgets of governments, who are allocating more capital to support the sector each year.

Fossil Fuels. The share of fossil fuels in energy supply investment rose last year for the first time since 2014, as spending in oil and gas increased modestly.

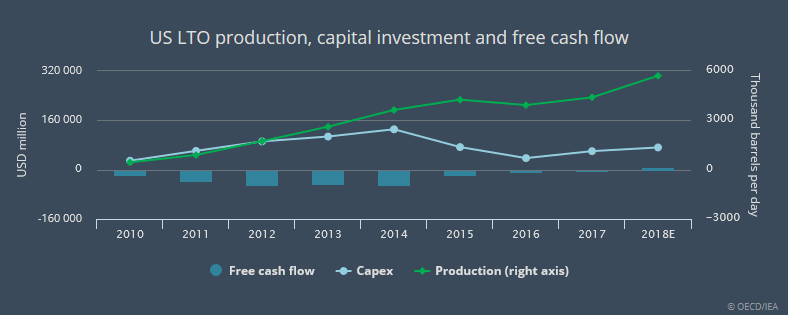

The prospects of the US shale industry are improving. Between 2010 and 2014, companies spent up to USD 1.8 for each dollar of revenue. However, the industry has almost halved its breakeven price. This underpins a record increase in US light tight oil (LTO) production of 1.3 million barrels a day in 2018. According to IEA estimates, the US shale industry may show a positive free cash flow this year, for the first time ever.

The improved prospects for the US shale sector contrast with the rest of the upstream oil and gas industry, said the IEA. Investment in conventional oil projects, which are responsible for the bulk of global supply, remains subdued. Investment in new conventional capacity is set to plunge in 2018 to about one-third of the total, a multi-year low raising concerns about the future energy supply.

Source: IEA WEI 2018