IEA releases World Energy Outlook 2018

13 November 2018

The International Energy Agency (IEA) released the World Energy Outlook (WEO) 2018—its flagship publication that details global energy trends and what possible impact they will have on supply and demand, carbon emissions, air pollution, and energy access. The report’s scenario-based analysis outlines different possible futures for the energy system across all fuels and technologies.

The IEA’s report warns that oil markets are entering a period of renewed uncertainty and volatility, as a mismatch between robust oil demand in the near term and a shortfall in new projects carries a risk of a sharp tightening of oil markets in the 2020s. The necessary global energy investment—including both conventional and renewable energy—is estimated in excess of $2 trillion (USD) per year through 2040. Over 70% of global energy investments will be government-driven. Therefore, the world’s energy destiny lies with decisions and policies made by governments, the IEA said.

The central scenario modeled in the report is called the New Policies Scenario (NPS). Under the NPS, energy demand is set to grow by more than 25% to 2040. The NPS is not a business-as-usual scenario—it includes not only current, but also future government policies, and assumes increased energy efficiency. Without increased efficiency, global energy consumption in 2040 would be almost 30% higher than projected in the NPS scenario.

Global CO2 emissions keep rising gradually to 2040 (NPS). Across sectors, there is particular growth in the transport and industry sectors. While emissions in advanced economies fall, that decline is more than made up by growing emissions in most developing economies.

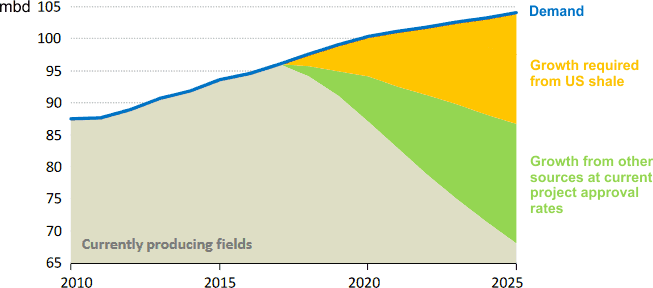

In the NPS, the WEO model shows oil consumption growing in coming decades, due to rising petrochemicals, trucking and aviation demand. But meeting this growth in the near term means that approvals of conventional oil projects need to double from their current low levels. Without such a pick-up in investment, US shale production, which has already been expanding at record pace, would have to add more than 10 million barrels a day (mbd) from today to 2025, Figure 1.

In power markets, renewables are predicted to become the technology of choice, making up almost two-thirds of global capacity additions to 2040, thanks to falling costs and supportive government policies. This is transforming the global power mix, with the share of renewables in generation rising to over 40% by 2040, from 25% today. However, fossil fuels (coal and natural gas) remain the largest source of electricity in 2040.

This expansion brings major environmental benefits, IEA says, but also a new set of challenges that policy makers need to address quickly. With higher variability in supplies, power systems will need to make flexibility the cornerstone of future electricity markets in order to keep the lights on. The issue is of growing urgency as countries around the world are quickly ramping up their share of solar PV and wind, and will require market reforms, grid investments, as well as improving demand-response technologies, such as smart meters and battery storage technologies.

Energy Efficiency. Energy efficiency is one of the cornerstones of any strategy to guarantee sustainable and inclusive economic growth. It remains one of the most cost-effective ways to enhance security of energy supply, to boost competitiveness and welfare, and to reduce the environmental footprint of the energy system, according to the IEA.

Global energy intensity, defined as the ratio of primary energy supply to GDP, is the indicator used to track progress on global energy efficiency. The original target was an annual reduction of 2.6% although the world has fallen short of this goal since it was announced: the annual reduction in 2017 was only 1.7%. This shortfall means that the required rate of intensity improvement has risen to 2.7% for the remaining years to 2030.

Improvements in fuel efficiency of the global car fleet are the single largest contributor to moderating oil demand growth in cars in the NPS. These measures avoid around 9 mbd of oil demand in 2040.

Investment. Global energy investment registered a slight decline in 2017 to $1.8 trillion, its third consecutive decline. Higher investment in several sectors, including energy efficiency and upstream oil and gas, were more than offset by lower power-sector investment. China was the main destination for energy investment, totaling more than a fifth of the total. As it did in 2016, the largest share of global investment went to the electricity sector, reflecting the growing role of electricity in the energy system.

In the New Policies Scenario, a pick-up in oil and gas investment to balance the near-term market, together with a slight rise in costs, mean that the share of spending on fossil fuels once again overtakes electricity in total supply investments. Energy efficiency investment increases in all end-use sectors. The buildings sector accounts for almost 40% of cumulative investment in energy efficiency, nearly 60% of which supports more energy-efficient houses, appliances and equipment.

In the NPS scenario, energy investment amounts to $2.2 trillion on average each year between 2018 and 2025, and $2.8 trillion a year thereafter. Average upstream oil and gas spending rises from $580 billion a year between today and 2025 to $740 billion a year from 2025 to 2040. Renewables continue to take the largest share of investment in power generation, with an average annual spend of $350 billion.

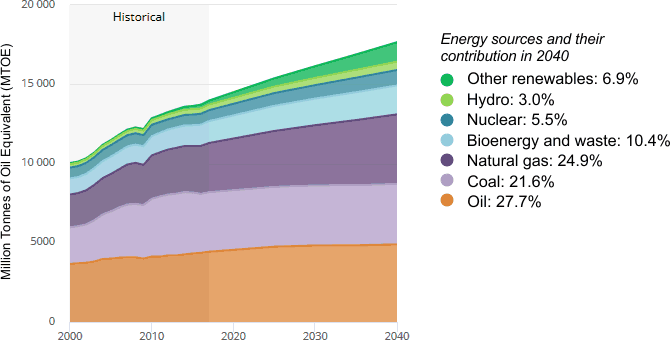

Primary Energy. The global demand for primary energy in the NPS scenario is shown in Figure 2. By 2040, fossil fuels (oil, gas and coal) will supply about 74% of primary energy, down from about 85% today. All types of renewables and nuclear power will supply about 26% of primary energy. The ‘other renewables’ category, which includes wind and solar, is predicted to supply 6.9% of global primary energy in 2040.

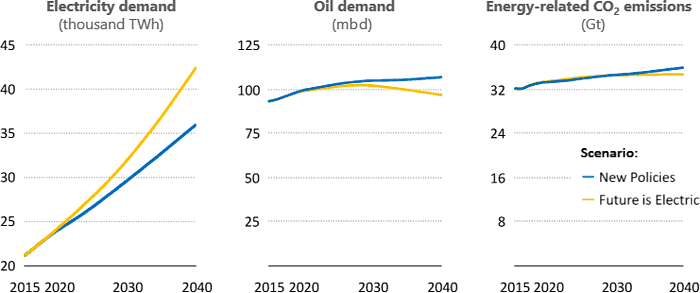

Electrified Future. The analysis introduces the Future is Electric Scenario (FiES), where economic opportunities for electrification are maximized. For instance, in the FiES by 2040, almost half of the car fleet goes electric; electricity makes rapid inroads into heating needs for buildings and industry; a digital economy connects nearly all consumer devices and appliances; and full electricity access is achieved.

The implications for energy and the environment are significant. Under FiES, oil demand would peak by 2030, and expenditures for electricity would overtake that of oil products before 2035. Electrification decreases air pollutant emissions, reducing premature deaths by nearly 2 million relative to the NPS. However, while electrification provides an avenue to decarbonize end-uses, overall energy sector carbon emissions will keep growing under this scenario (Figure 3) without stronger efforts to decarbonize electricity supply. Electrification alone is not sufficient to put the world on track to meet climate goals; this would require a more comprehensive energy system strategy, the IEA report concludes.

In summary, the World Energy Outlook modeling suggests that de-carbonization of the world’s energy system and the economy is a task much more challenging than often believed, and may not be compatible with continuing economic growth.

Source: IEA