BP releases Energy Outlook 2019

16 February 2019

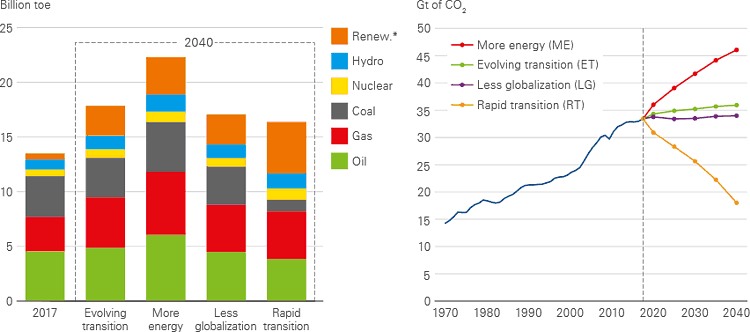

BP released the 2019 edition of its Energy Outlook, which analyzes the trends in global energy markets out to 2040. The greatest uncertainties identified by BP involve the need for more energy to support continued global economic growth, together with the need for a more rapid transition to a lower-carbon future.

Please log in to view the full version of this article (subscription required).

The central scenario in the Outlook is the Evolving Transition (ET) scenario, which assumes that government policies, technologies and societal preferences evolve in a manner and speed similar to the recent past. In the ET scenario:

- Global energy demand increases by around a third by 2040, driven by improvements in living standards, particularly in India, China and across Asia.

- Global carbon emissions continue to rise.

- Energy consumed by industry and buildings accounts for around 75% of the increase in overall energy demand, while growth in energy demand from transport slows sharply relative to the past as gains in vehicle efficiency accelerate.

- The power sector uses around 75% of the increase in primary energy.

- 85% of the growth in energy supply is generated through renewable energy and natural gas, with renewables becoming the largest source of global power generation by 2040.

- Demand for oil grows in the first half of the Outlook period—consumption of liquid fuels increases by 10 mbd (from 98 mbd to 108 mbd)—before gradually plateauing, while global coal consumption remains broadly flat.

- Across all Outlook scenarios, significant levels of continued investment in new oil will be required to meet oil demand in 2040.

* Renewables includes wind, solar, geothermal, biomass, and biofuels

Other scenarios considered in the Outlook include:

-

More energy—This scenario explores the increased energy demand that would be needed to support growth and enable billions of people to move from low to middle incomes.

There is a strong link between human progress and energy consumption; the UN Human Development Index suggests that increases in energy consumption of up to around 100 GJ per head are associated with substantial increases in human development and well-being. Today, around 80% of the world’s population live in countries where average energy consumption is less than 100 GJ per head. In order to reduce that number to one-third of the population by 2040, the world would require around 65% more energy than today, or 25% more energy than needed in the evolving transition scenario. The increase in energy required over and above the evolving transition scenario is roughly the equivalent of China’s entire energy consumption in 2017.

-

Rapid transition—This scenario brings together lower carbon policy measures for industry and buildings, transport and power. Doing so results in around a 45% decline in carbon emissions by 2040 relative to current levels. However, even in the rapid transition scenario, a significant level of carbon emissions remain in 2040.

The decrease of energy consumption in this scenario reflects a combination of gains in energy efficiency; a switch to lower-carbon fuels; material use of carbon capture, utilization, and storage (CCUS); and—of particular importance in the power sector—a significant rise in the carbon price. The power sector is currently the single largest source of carbon emissions from energy use. Reductions in carbon emissions from the transport industry in all scenarios to 2040 is relatively small in comparison.

- Less globalization—International trade underpins economic growth and allows countries to diversify their source of energy. In the less globalization scenario the Outlook explores the possible impact that escalating trade disputes could have on the global energy system. The scenario highlights how a reduction in openness and trade associated with an escalation in trade disputes could reduce worldwide GDP and therefore energy demand.

Although the precise outlook is uncertain—BP said in the Outlook—the world looks set to consume significant amounts of oil (crude plus NGLs) for several decades. The Outlook considers a range of scenarios for oil demand, with peak oil timing varying from the next few years to beyond 2040. Despite these differences, the scenarios share two common features:

- First, all the scenarios suggest that oil will continue to play a significant role in the global energy system in 2040, with the level of oil demand in 2040 ranging from around 80 mbd to 130 mbd.

- Second, significant levels of investment are required for there to be sufficient supplies of oil to meet demand in 2040. If future investment was limited to developing existing fields and there was no investment in new production areas, global production would decline at an average rate of around 4.5% per year, implying global oil supply would be only around 35 mbd in 2040. Closing the gap between this supply profile and any of the demand scenarios would require many trillions of dollars of investment over the next 20 years.

Source: BP Energy Outlook