What is the long term potential of US shale resources?

14 November 2019

US shale resources—light tight oil (LTO) and shale gas—provided a new lease on life for US and world’s oil and gas production. In recent years, the global oil demand growth has been satisfied almost entirely by the growth in US production from shale, while the net oil production growth in other areas of the world has been marginal. A critically important question for future energy policies anywhere in the world is how sustainable is US shale production in the long term.

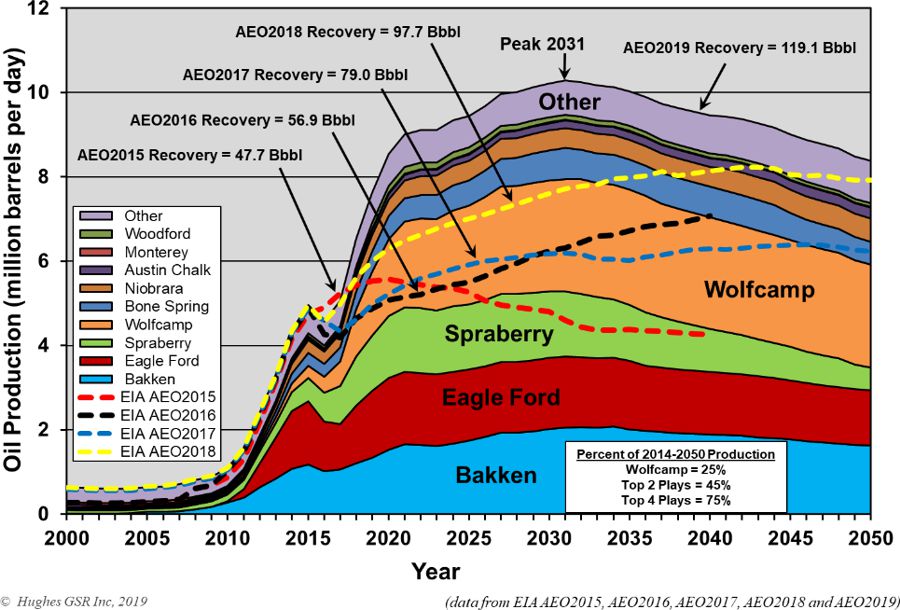

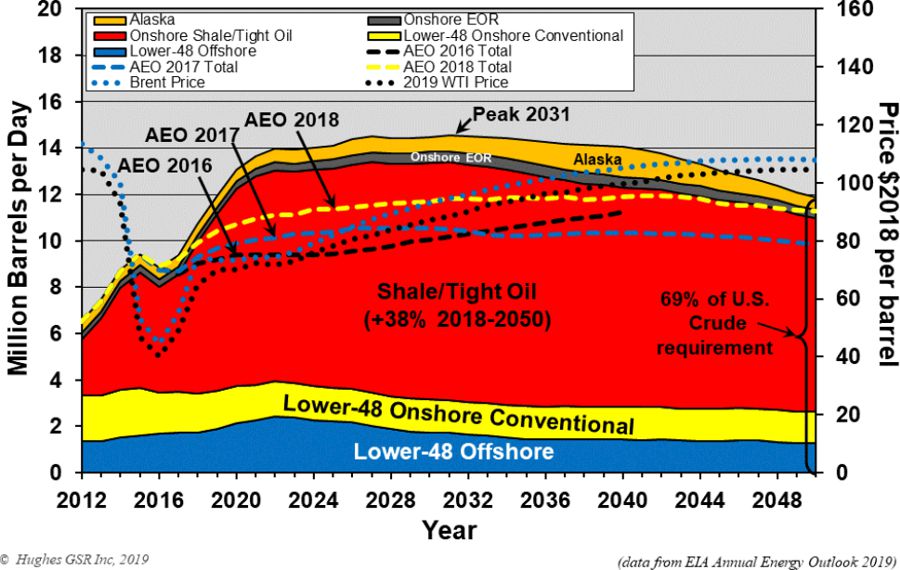

Each year, the US Department of Energy’s Energy Information Administration (EIA) publishes its Annual Energy Outlook which reviews US energy sources and forecasts supply through 2050, the latest version of which (AEO2019) was released in early 2019. This latest forecast envisions LTO production growth, albeit at a slower rate, for one more decade. The total LTO recovery figure through 2050 has been increased to 119.1 billion barrels, from 97.7 billion predicted in AEO2018, with peak LTO production of more than 10 million barrels per day (mbd) occurring in 2031.

This vision of the “shale revolution” to continue for at least another decade is shared by the International Energy Agency (IEA). In its World Energy Outlook 2019 (WEO2019) released this week, the IEA forecast US LTO production to grow from 6 mbd in 2018 to a peak of 11 mbd in 2035 (Stated Policies Scenario). The United States will account for the overwhelming share of global oil production growth, at 85%, by 2030.

(Source: Shale Reality Check 2019)

(Source: Shale Reality Check 2019)

On the other hand, a number of independent oil and gas experts have been warning that the “official” LTO production forecasts might underestimate the looming capital investment barrier faced by the industry, which is the result of decreasing EROI (energy return on invested) and increasing extraction costs of unconventional oil and gas resources. The nature of shale reservoirs is that they decline quickly, such that production from individual wells falls 75–90% in the first three years, and first-year field declines without new drilling typically range from 25–50% [4571]. High rates of capital investment in new drilling are therefore required to avoid steep production declines.

In the newest edition of the Shale Reality Check report released on November 12 [4571], David Hughes presents a detailed analysis of the EIA AEO2019 LTO production forecast and finds that the EIA reference case play-level production estimates through 2050 are extremely optimistic and therefore highly unlikely to be realized. Key findings of the report include:

- Of the 13 shale plays analyzed, nine are rated as extremely optimistic, three highly optimistic,and one moderately optimistic.

- In some cases, EIA play-level production forecasts through 2050 exceed the EIA’s own estimates of proven reserves plus unproven resources, and all plays are forecast to recover all proven reserves and a high percentage of unproven resources by 2050. The overall forecast falls short by nearly ten billion barrels of oil, or 10% of the required production volume.

- In most cases, forecasts exit 2050 at high production levels, often significantly higher than current production rates, implying that vast additional resources would remain after 2050.

- Given the EIA’s forecast of requiring production from “other” plays outside of the major plays analyzed in the report, 1,558,910 additional wells would be required for shale plays over 2017-2050 at a cost of $11 trillion, due to the low estimated ultimate recovery of wells outside of major plays.

- Well productivity has increased in most plays through focusing on sweet spots and due to longer horizontal laterals and increased volumes of water and proppant, as well as more fracking stages. The limits of technology and exploiting sweet spots are becoming evident, however, as in some plays new wells are exhibiting lower productivities.

The best-case scenario to meet the EIA AEO2019 reference case forecast was found to require drilling 1,451,771 wells at a cost of $9.5 trillion over the 2017-2050 period.

Although there is no doubt that the United States can produce substantial amounts of shale gas and tight oil over the short-and medium-term, unrealistic long-term forecasts are a disservice to planning a viable long-term energy strategy, the report notes.

Source: Post Carbon Institute