IEA, IRENA analyze trends in renewable energy markets

11 November 2020

Two new reports have been released this week that analyze trends in renewable energy markets, including wind and solar power, biofuels, and other forms of renewable energy: the Renewables 2020 report by the International Energy Agency (IEA) and the Global Landscape of Renewable Energy Finance 2020 by the International Renewable Energy Agency (IRENA) and Climate Policy Initiative (CPI).

The IEA estimates that the use of renewables for electricity generation will increase by 7% this year, despite a predicted 5% decline in global energy demand. Even though the use of biofuels in industrial activity and transportation will decline this year, the increase in renewable power generation will be strong enough to offset it, with the net increase in renewable energy demand seen at 1%.

The strong growth in the consumption of wind and solar electricity has been driven by long-term contracts, continuous installation of new plants, and by priority access to the grid. The latter incentive means that the operators of wind and solar powerplants have been insulated from any risk due to the Covid-related demand reduction, while all losses have to be incurred by conventional (coal, gas, and nuclear) powerplants. Unsurprisingly, investor appetite for exposure to renewable energy remains strong, noted the IEA.

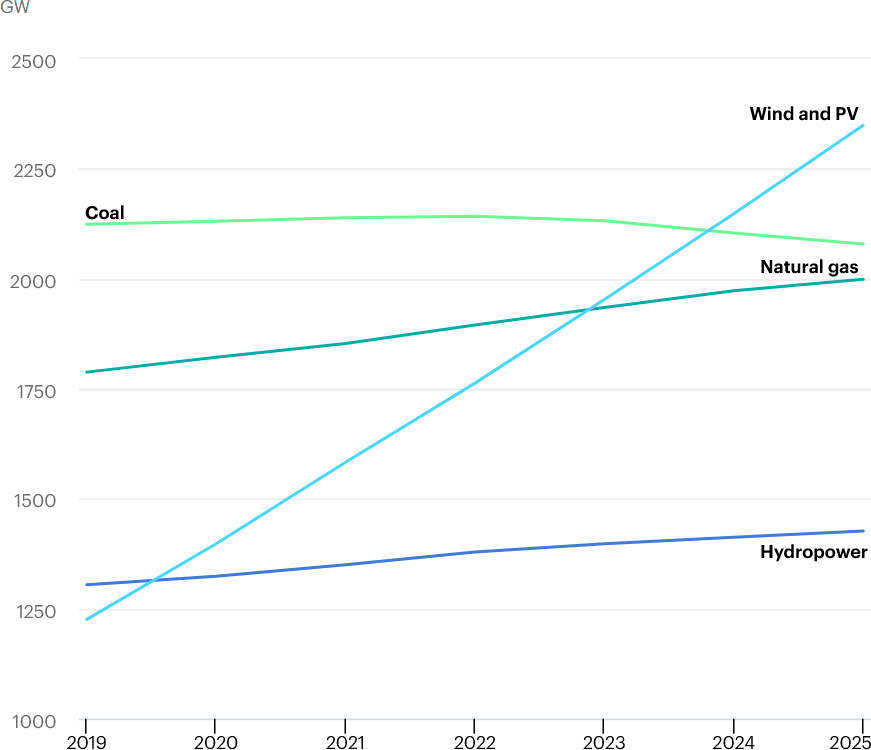

Cost reductions and sustained policy support are expected to drive strong renewables growth beyond 2022, said the IEA. Total installed wind and solar PV capacity is on course to surpass natural gas in 2023 and coal in 2024, Figure 1. Solar PV accounts for 60% of all renewable capacity additions through 2025, and wind provides another 30%.

(Source: IEA Renewables 2020)

Renewables are predicted to overtake coal to become the largest source of electricity generation worldwide in 2025. By that time, they are expected to supply one-third of the world’s electricity. Hydropower will continue to supply almost half of global renewable electricity. It is by far the largest source of renewable electricity worldwide, followed by wind and solar PV.

Despite the renewables’ “resilience” to the Covid crisis, the pace of solar PV and onshore wind additions slowed in the first half of 2020. Global renewable electricity capacity additions were over 11% lower in the first half of 2020 than in the first six months of 2019. The IEA estimates that developers connected an estimated 40 GW of solar PV, 17% less than last year, while wind expansion was down nearly 8%. According to the IRENA report, with the onset of the Covid pandemic, global renewable energy investments dropped by 34% in the first half of 2020, compared to the same period the year before.

Global investment in renewable energy made significant progress between 2013 and 2018, with a cumulative $1.8 trillion (USD) invested, estimates the IRENA report. Renewable energy investment reached USD 322 billion in 2018, with modest growth seen to continue through 2019. However, to ensure a “climate-safe future”, annual investment in renewables—including various types of power generation, solar heat and biofuels—would have to almost triple to $800 billion by 2050, IRENA said.

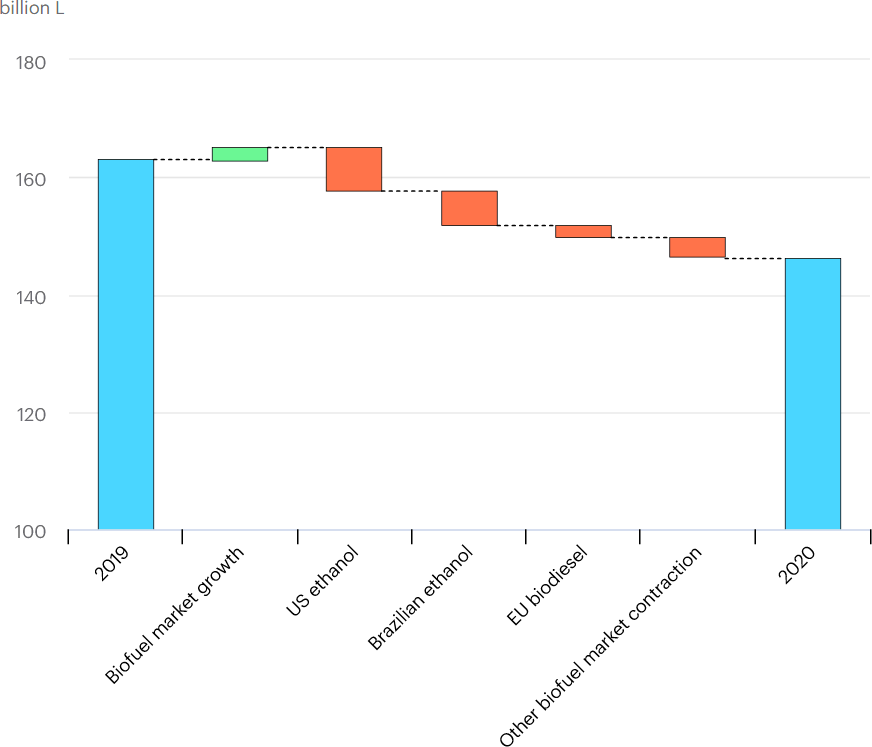

In contrast to renewable power, the global transport biofuel production in 2020 is anticipated to decline by 12% from 2019’s record, Figure 2. This is the first reduction in annual production in two decades, driven by both lower transport fuel demand and lower fossil fuel prices diminishing the economic attractiveness of biofuels.

(Source: IEA Renewables 2020)

The IEA predicts that a recovery in fuel demand and stronger policies in key markets can spur a rebound in production in 2021 and sustained growth through 2025. The greatest production increases in this case would be for ethanol in China and Brazil, and for biodiesel and hydrotreated vegetable oil in the United States and Southeast Asia.

Source: IEA | IRENA