IEA: Critical materials play essential role in clean energy transitions

5 May 2021

The International Energy Agency (IEA) released a special report, The Role of Critical Minerals in Clean Energy Transitions, that examines the central importance of minerals such as copper, lithium, nickel, cobalt and rare earth elements in a secure and rapid transformation of the global energy sector. The report recommends key areas of action for policy makers to ensure that critical minerals enable an accelerated transition to clean energy technologies—like electric vehicles and wind turbines—rather than becoming a bottleneck.

“Today, the data shows a looming mismatch between the world’s strengthened climate ambitions and the availability of critical minerals that are essential to realizing those ambitions,” said Fatih Birol, Executive Director of the IEA. “The challenges are not insurmountable, but governments must give clear signals about how they plan to turn their climate pledges into action. By acting now and acting together, they can significantly reduce the risks of price volatility and supply disruptions.”

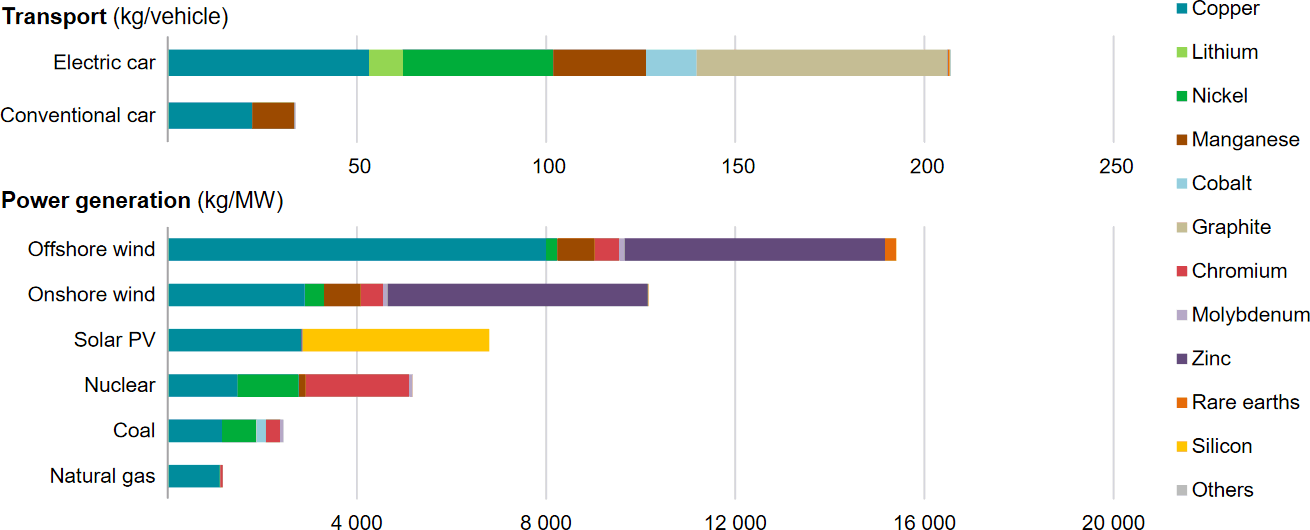

The report underscores that the mineral requirements of an energy system powered by clean energy technologies differ profoundly from one that runs on fossil fuels. A typical electric car requires six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a similarly sized gas-fired power plant.

(Source: IEA)

The energy sector’s overall needs for critical minerals could increase by as much as six times by 2040, estimates the report, depending on how rapidly governments act to reduce emissions. Not only is this a massive increase in absolute terms, but as the costs of technologies fall, mineral inputs will account for an increasingly important part of the value of key components, making their overall costs more vulnerable to potential mineral price swings.

The commercial importance of these minerals also grow rapidly: today’s revenue from coal production is ten times larger than from energy transition minerals. However, in climate-driven scenarios, these positions are reversed well before 2040.

To produce the report, the IEA analyzed future mineral requirements under varying scenarios that span a range of levels of climate action and 11 different technology evolution pathways. In climate-driven scenarios, mineral demand for use in batteries for electric vehicles and grid storage is a major force, growing at least thirty times to 2040. The rise of low-carbon power generation to meet climate goals also means a tripling of mineral demand from this sector by 2040. Wind takes the lead, bolstered by material-intensive offshore wind. Solar PV follows closely, due to the sheer volume of capacity that is added. The expansion of electricity networks also requires a huge amount of copper and aluminum.

Unlike oil—a commodity produced around the world and traded in liquid markets—production and processing of many minerals such as lithium, cobalt and some rare earth elements are highly concentrated in a handful of countries, with the top three producers accounting for more than 75% of supplies. Complex and sometimes opaque supply chains also increase the risks that could arise from physical disruptions, trade restrictions or other developments in major producing countries. In addition, the quality of available deposits is declining as the most immediately accessible resources are exploited.

The IEA report provides six key recommendations for policy makers to foster stable supplies of critical minerals to support accelerated clean energy transitions. These include the need for governments to lay out their long-term commitments for emission reductions, which would provide the confidence needed for suppliers to invest in and expand mineral production.

Governments should also scale up recycling, including EV battery recycling. The lithium-ion battery recycling industry is in its nascent stages, says the report. Unlike the already mature lead-acid battery recycling industry, the lithium-ion battery recycling industry needs to address several challenges in order to reach scale and profitability.

The proposed EU Sustainable Batteries Regulation would addresses the social, economic and environmental issues related to all types of batteries, including those imported into the bloc. The proposal covers the entire battery life cycle, and directly applies to lithium, cobalt, nickel and copper supply chains.

Source: IEA