ExxonMobil warns about looming oil supply crisis

29 August 2024

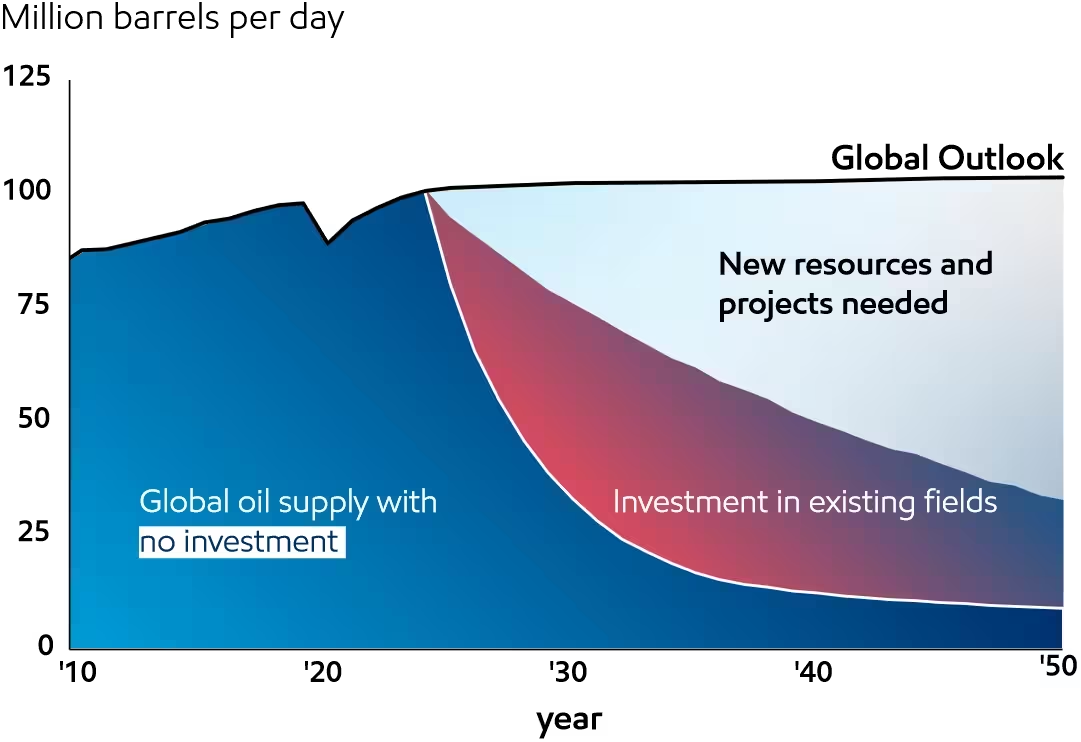

ExxonMobil released a new edition of its Global Outlook, which summarizes ExxonMobil’s view of energy demand and supply through 2050. The Outlook predicts that both oil and natural gas will continue to be essential components of the world’s energy supply, with demand for oil remaining above 100 million barrels per day (b/d) in 2050. However, as the world’s demand remains strong, sustaining investment in oil and natural gas is more important than ever.

The Outlook analysis is based on the assumption that the global population will increase from 8 billion today to 10 billion people by 2050. This will drive a 15% increase in total energy use worldwide between now and 2050—primarily to enable economic growth in developing countries. By contrast, energy use in developed nations is projected to decline by more than 10% due to efficiency improvements.

Key findings from the ExxonMobil Global Outlook include:

- Global oil demand will reach a plateau beyond 2030, remaining above 100 million b/d through 2050—making up >50% of the world’s energy mix. While the demand for gasoline for passenger cars will drop, making gasoline is a relatively small use for oil. The large majority of the world’s oil is and will be used for industrial processes along with heavy-duty transportation like shipping, trucking, and aviation. If every new car sold in the world in 2035 were electric, oil demand in 2050 would still be 85 million b/d, the same as it was in 2010.

- Global carbon emissions will start to fall for the first time by 2030, even as developing economies grow and consume more energy. The Outlook sees carbon emissions to decline by 25% through 2050.

- Electricity use will grow by 80% by 2050. Solar and wind electricity will increase by more than 4× in the total energy mix, from less than 3% in 2023 to 12% in 2050. Coal will continue to be displaced by lower-emission sources, including natural gas.

However, global oil and natural gas supplies can virtually disappear without continued investment, warns the report. The Outlook reflects oil production naturally declining at a rate of about 15% per year—nearly double the IEA’s prior estimates of about 8%. This increase is the result of the world’s shifting energy mix toward “unconventional” sources of oil and natural gas. These are mostly shale and dense rock formations where oil and gas production typically declines faster.

(Source: ExxonMobil Global Outlook)

Accordingly, without new investment and new resources, global oil supplies would fall by more than 15 million b/d in the first year alone, states ExxonMobil. At that rate, by 2030, oil supplies would fall from 100 million b/d to less than 30 million—that’s 70 million barrels short of what’s needed to meet demand every day.

Source: ExxonMobil Global Outlook