Shell forecasts global LNG demand to grow 60% by 2040

27 February 2025

Global demand for liquefied natural gas (LNG) is forecast to rise by around 60% by 2040, largely driven by economic growth in Asia, emission reductions in heavy industry and transport, as well as the impact of artificial intelligence, according to Shell’s LNG Outlook 2025.

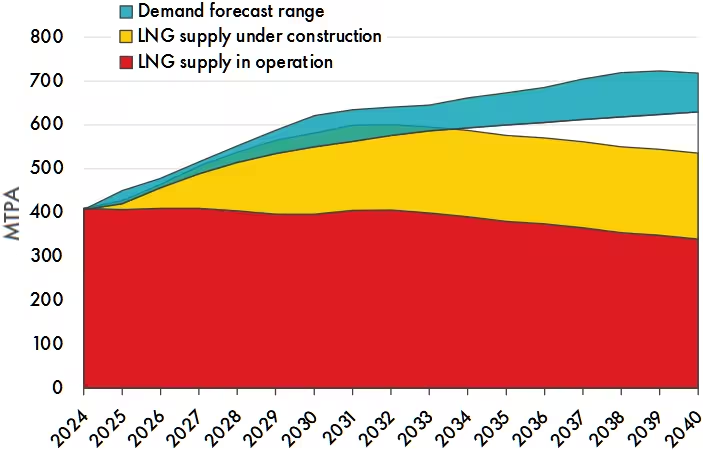

Industry forecasts now expect LNG demand to reach 630-718 million tonnes a year (MTPA) by 2040, a higher forecast than last year. Meanwhile, global LNG trade grew by only 2 million tonnes in 2024, the lowest annual increase in 10 years, to reach 407 million tonnes due to constrained new supply development.

“Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonization goals,” Tom Summers, Senior Vice President for Shell LNG Marketing and Trading, said.

LNG spot prices strengthened throughout 2024. While prices are still below the highs of 2021-2023, unexpected factors fueled volatility. In Q4 2024, ongoing threats of Russian pipeline supply curtailment via Ukraine and weak European storage-fill triggered scarcity fears.

The Shell LNG Outlook predicts growing LNG demand and from China, India and other Asian economies. China is significantly increasing its LNG import and regasification capacity and also aims to add piped gas connections.

In the marine sector, a growing order book of LNG-powered vessels will see demand from this market rise to more than 16 million tonnes a year by 2030, up 60% from the previous forecast.

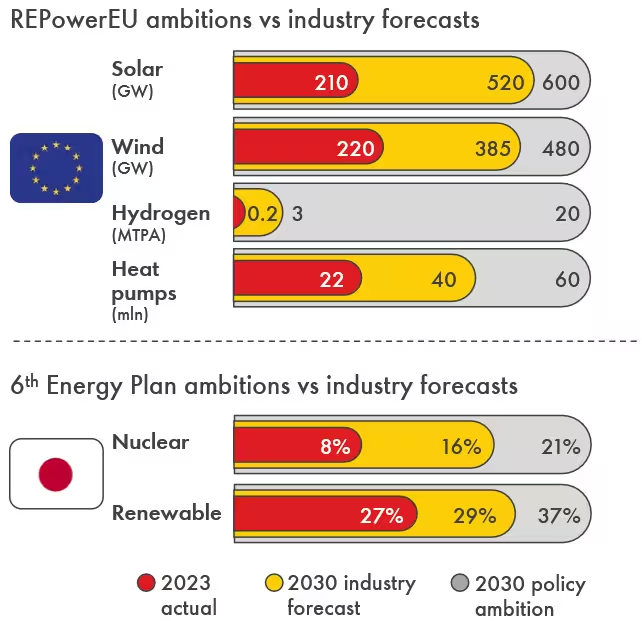

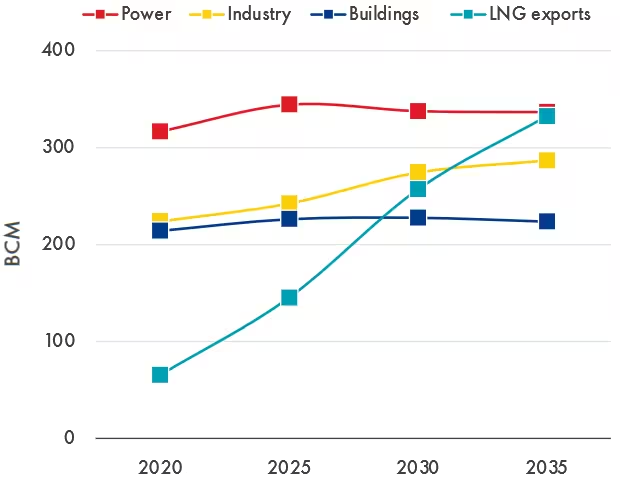

Europe—in spite of weak LNG demand in 2024 when imports fell by 23 million tonnes (19%)—is predicted to need LNG into the 2030s to balance the growing share of intermittent renewables in its power sector. LNG is expected to provide energy security in transitioning markets, as both the European Union and Japan are falling short of their energy transition policy goals.

On the supply side, declining reserves slow legacy LNG exports. Algeria, Egypt, Malaysia and Indonesia are all predicted to export less to the global market through 2040. From 2022 to 2024, the global LNG supply forecast has been reduced by some 30 MTPA, as new project development faces multiple challenges, from geopolitical tensions and regulatory hurdles to supply chain bottlenecks.

Shell expects the global LNG industry to increase its reliance on exports from the United States and Qatar. The USA is set to extend its lead as the world’s largest LNG exporter, potentially reaching 180 million tonnes a year by 2030 and accounting for a third of global supply.

However, the report notes that future US LNG growth comes with risks. While Shell does not go into detail about US LNG risk factors, it should be noted that US natural gas output remained steady since 2023 and further growth would likely require higher oil and gas prices.

While significant new LNG supply capacity is under construction, the Shall Outlook warns that more investment is needed to ensure that future supply can keep up with demand. The report predicts that global LNG supply shortages may emerge already around 2030.

Source: Shell LNG Outlook