Rystad: Conventional oil discoveries continue to decline

23 October 2025

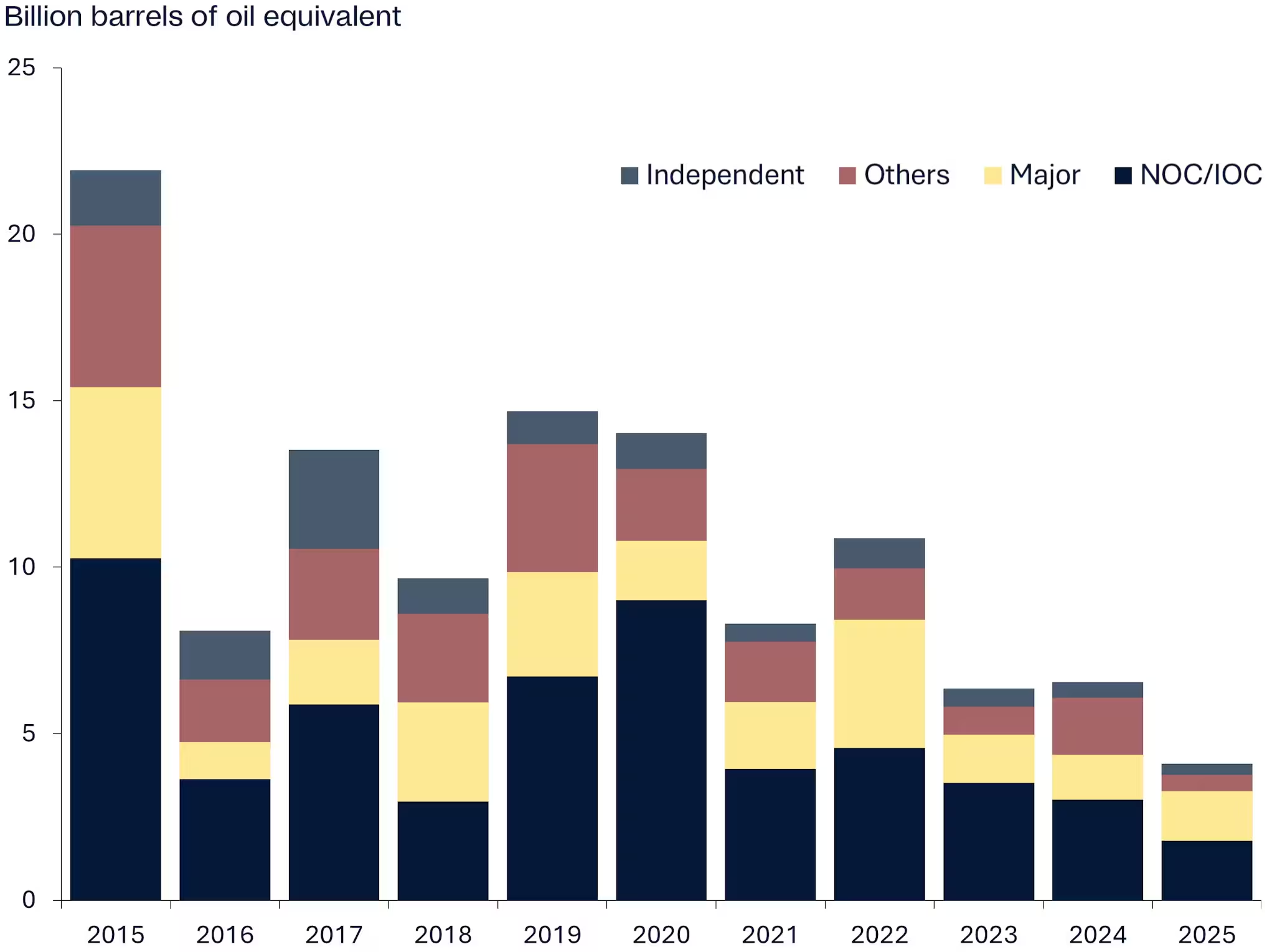

Annual conventional discovered volumes once averaged more than 20 billion barrels of oil equivalent (boe) per year in the early 2010s, but these have fallen to nearly one-third of that. An analysis by Rystad Energy shows that global discoveries have averaged slightly over 8 billion boe annually since 2020, despite several standout frontier finds in Namibia, Suriname and Guyana.

The yearly average declined further to about 5.5 billion boe between 2023 and September 2025—threatening a decline in global oil output and energy security.

(Source: Rystad Energy)

New discoveries are concentrated in a handful of countries or specific hotspots—Namibia, Guyana, Brazil, and Suriname, among others—highlighting the narrowing geography of exploration success. Most of the recent discoveries have been in under-explored and technologically challenging plays such as ultra-deepwater.

Both international oil majors and national oil companies (NOC) continue to play a pivotal role in sustaining global exploration and discovered volumes. The group of six oil majors—ExxonMobil, TotalEnergies, Shell, Eni, BP, and Chevron—accounts for about 22% of discovered volumes since 2015, according to Rystad Energy estimates. These organizations remain the primary drivers of frontier exploration, while NOCs—such as Petrobras, ADNOC, and QatarEnergy—have been focused on exploring their domestic and regional basins. Together, the majors and NOCs dominate the high-impact deepwater discoveries that continue to anchor global supply growth.

Beneath the continuously shrinking discovery curve is a dramatic fall in exploration expenditure (expex), which now hovers around $50 billion to $60 billion per year—down from a peak of around $115 billion in 2013.

Source: Rystad Energy