BNEF: Li-ion battery prices fall despite rising metal prices

11 December 2025

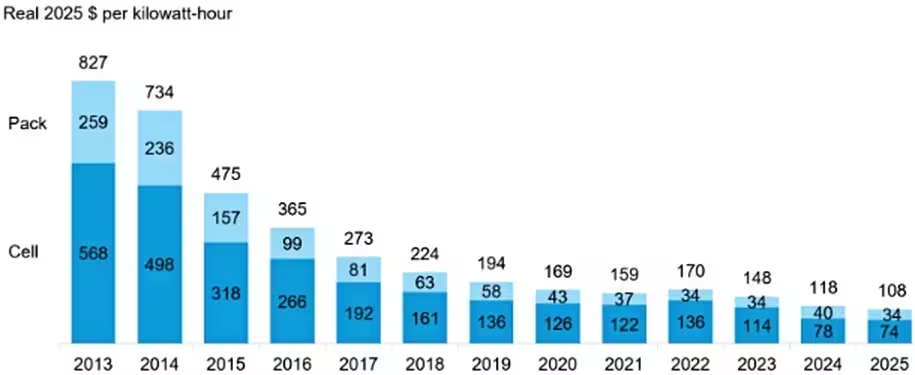

Lithium-ion battery pack prices have dropped 8% since 2024 to a record low of $108 per kWh, according to the latest battery price survey by BloombergNEF (BNEF). Prices have declined due to continued cell manufacturing overcapacity, intense competition, and the ongoing shift to lower-cost lithium iron phosphate (LFP) batteries—despite an increase in battery metal costs.

Battery metal prices increased in 2025, in part due to supply risks at certain Chinese lithium assets and new cobalt export quotas in the Democratic Republic of Congo. However, metal price increases did not translate to higher annual prices for cells or packs. The industry ultimately absorbed these shocks through greater LFP adoption, long-term contracts, and broader hedging strategies—according to the BNEF’s analysis.

China has consistently produced more cells than are needed for domestic electric vehicle and stationary storage demand, creating intense competition among manufacturers. The effect has been most pronounced in the stationary storage sector, where many suppliers can serve the same projects. China’s dominance in LFP production has allowed its producers to meet nearly all global demand.

Survey value for 2025 includes 320 data points from passenger cars, buses, commercial vehicles, two- and three-wheelers and stationary storage. EV packs consist of cells, module housing, battery management system (BMS), wiring, pack housing and thermal management system. Stationary storage prices include the battery rack, which holds stacked cells, modules, or packs, including the BMS, wiring and the rack housing. Source: BNEF.

The BNEF’s survey covers multiple battery end-uses, including different types of electric vehicles and stationary storage projects. Each sector typically requires different cells and packs, leading to varied pricing dynamics across these use cases. Battery pack prices for stationary storage dropped to $70/kWh in 2025, 45% lower than in 2024. This is the sharpest drop across all segments, making stationary storage the lowest-priced segment for the first time. Battery electric vehicles (BEV) packs were the cheapest in the transport segment at $99/kWh—the second year that they were below the $100/kWh threshold.

Average LFP battery pack prices across all segments came in at $81/kWh while nickel manganese cobalt (NMC) packs were at $128/kWh.

The report also covers regional differences in pricing. Average battery pack prices were lowest in China, at $84/kWh. Pack prices in the North America and Europe were 44% and 56% higher, reflecting higher local production costs and greater dependence on imported batteries, which typically have a premium compared to prices in China. The largest drop in pack prices was in China, down 13% in real terms from 2024, while North America and Europe saw declines of 4% and 8%, respectively.

The drop in prices was higher in Europe than in North America due to the changing policy and tariff environment in the USA. Many Chinese companies redirected their exports to European markets, where they adopted more aggressive pricing strategies to maintain global sales volumes and meet annual targets. This shift intensified price competition in Europe.

BNEF expects pack prices to decrease again in 2026, based on its near-term outlook, as raw material prices face upward pressure but adoption of low-cost LFP continues to spread.

Source: BloombergNEF