BloombergNEF: Demand for critical metals outpacing supply

6 December 2025

Rising demand for some critical metals is outpacing supply chain capacity, creating structural market imbalances, according to BloombergNEF’s Transition Metals Outlook 2025. Copper, graphite, aluminum, lithium, cobalt and manganese are all seeing sharp demand increases thanks to electric vehicles, energy storage, grid expansion and data centers.

According to the report, China continues to dominate global supply chains, holding midstream capacity in aluminum, graphite, manganese, cobalt, and rare earths. For the past 30 years, China has been developing its mineral empire by sizable investment into securing raw materials from the world’s suppliers, securing access to crucial mines in countries like Australia, Chile, Indonesia, and Congo, and then systematically building out massive processing capabilities—to become the lowest-cost producer globally. While other regions have made efforts to diversify, upstream refining capacity remains largely concentrated in China, leaving many regions dependent on imports and exposing global supply chains to disruption.

Key findings of the report include:

-

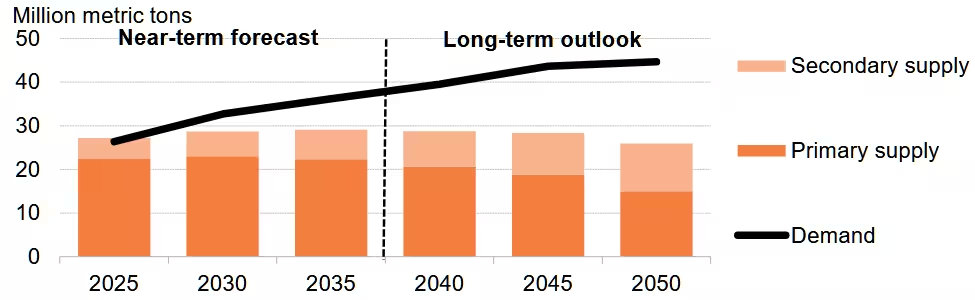

Among critical metals, copper faces significant pressure, with the market entering a structural deficit next year and facing a projected shortfall of 19 million tonnes by 2050 if new mines and recycling facilities are not developed.

Global copper market balance (Source: BloombergNEF)

- Graphite is expected to face a technical deficit after 2030 as battery demand grows faster than primary supply.

- Cobalt prices are likely to remain elevated in 2026 as a result of the Democratic Republic of Congo’s export ban.

- Lithium production is set to expand significantly, supported by new extraction projects in South America and Africa and increased recycling of retired batteries. Total lithium capacity from both primary and secondary sources could reach 4.4 million tonnes of lithium carbonate equivalent by 2035, up from 1.5 million tonnes LCE in 2025.

The analysis highlights the growing importance of policy and investment in shaping metals markets, as well as developments in company strategy. Recent interventions in cobalt production in Congo have helped stabilize prices. Major mining companies—including BHP, Anglo American, Rio Tinto and Glencore—have begun to prioritize capital expenditure over shareholder distributions.

Decarbonizing metal production is also critical as renewables scale, according to the report. Steel, aluminum and copper contribute the majority of embodied emissions in wind and solar projects. Operational carbon offsets allow many technologies to achieve payback in just months, but neglecting upstream decarbonization prolongs embedded emissions.

Source: BloombergNEF