EU market share of diesel cars falls to 36%, the lowest since 2001

4 February 2019

The European car market remained unchanged during 2018, as 15.6 million vehicles were registered—346 more than in 2017—according to data by Jato Dynamics. It was the best result since 2007, when the market peaked with 16.02 million registrations. Strong results in Q2, where the market was up by 4.8%, and Q3, where the market was up by 1.1%, were enough to offset the large decline posted in Q4, where the market dropped by 7.5% and recorded its lowest volume since 2014. The registrations in Q4 were affected by EU regulatory changes—the introduction of WLTP and RDE testing—and the resulting lack of availability of many key vehicle versions.

Diesel vehicles posted their lowest market share since 2001, as demand fell by double digits in 20 of the 27 markets included in JATO’s analysis, with the biggest drops in the UK (-30%), Scandinavia (-22%) and Benelux (-22%). “Throughout 2018 we continued to see the effects of the diesel crisis, as announcements of policy changes by governments led to confusion and panic among consumers,” Jato Dynamics said.

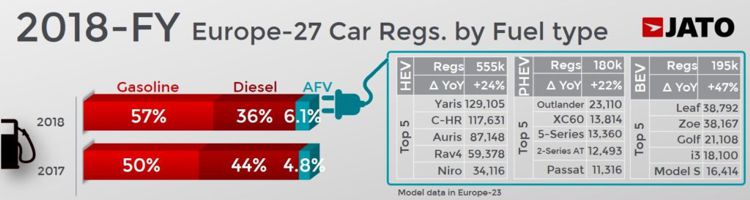

Diesel vehicles counted for just 36% of all registrations, as their market share dropped 8 percentage points on 2017 and 19 points on 2011—the peak year for the fuel type when EU diesel sales reached 55%.

Most customers who moved away from diesels chose to buy gasoline vehicles—the majority of vehicles registered in 2018 were powered by gasoline engines, with the fuel type making up 57% of all registrations. This result marks a 7-point market share increase on 2017 and a 12-point increase in 10 years.

Some 930,000 alternative fueled vehicles (AFV = HEV + PHEV + BEV), almost 200,000 more than in 2017, were registered in 2018. The AFVs market share reached 6.1%. In this total, electrically chargeable vehicles represented 375,000 registrations, or a 2.4% market share (PHEV = 180,000; BEV = 195,000).

Despite growing at a slower rate than in previous years, the shift from cars to SUVs continued in 2018. In total, 5.4 million SUVs were registered in Europe throughout the year, up 19% on 2017, as their market share increased from 29.2% to 34.6%.

Diesel has managed to hold on to its position at the top of the premium brands. Despite the turmoil, it is still the most preferred fuel type for consumers buying Audi, Mercedes, BMW, Volvo and many others. Among the top 10 brands with the highest diesel penetration, 8 of them were premium brands, and diesel counted for more than half of their registrations.

Source: Jato Dynamics