IEA: Global energy security and sustainability concerns are growing

13 May 2019

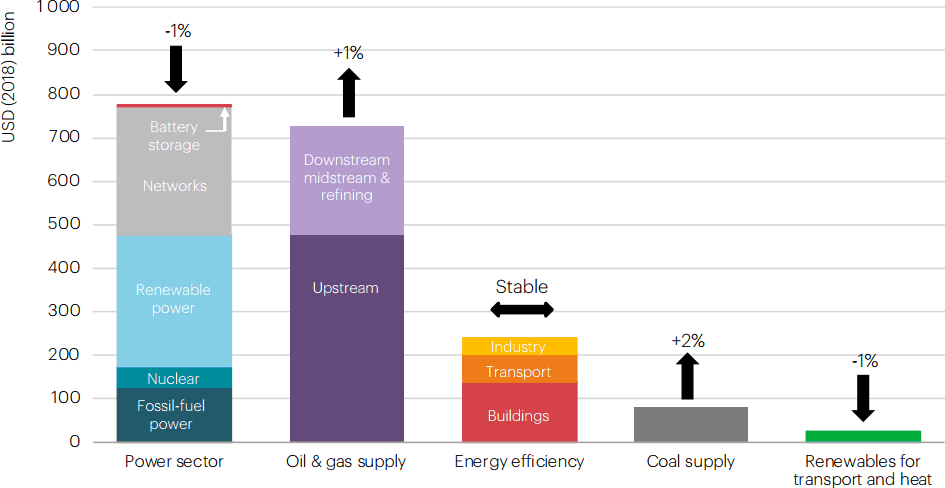

Global energy investment stabilized in 2018, ending three consecutive years of decline, as capital spending on oil, gas and coal supply bounced back while investment stalled for energy efficiency and renewables, according to the World Energy Investment 2019 (WEI 2019) report by the International Energy Agency (IEA).

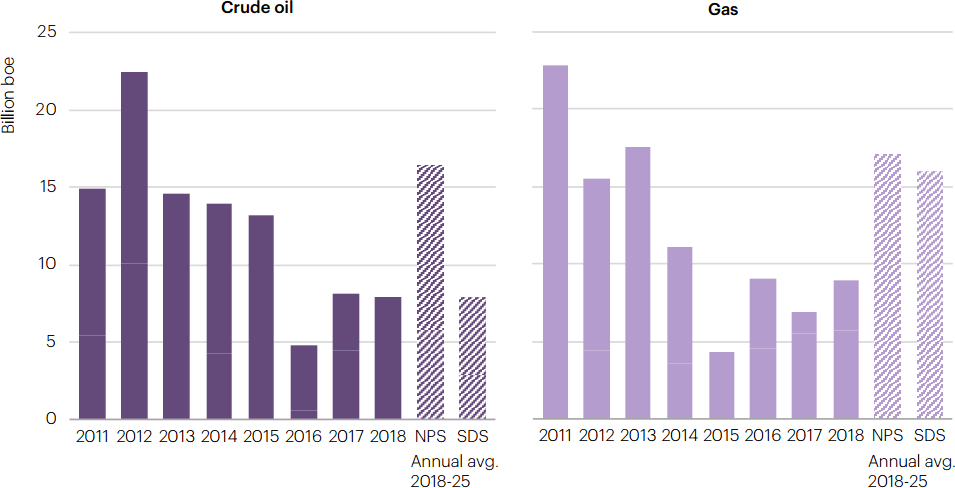

The findings of the report signal a growing mismatch between current energy investment and the global energy supply needs—under both the current policy trends (NPS scenario), as well as the paths to meeting the Paris Agreement and other sustainable development goals (SDS scenario), the IEA warned. Concerns about the adequacy of world’s energy supply to support the envisioned continued economic growth have been raised by the IEA on several occasions, including the 2018 edition of the WEI report.

Global energy investment totaled more than USD 1.8 trillion in 2018, a level similar to 2017. For the third year in a row, the power sector attracted more investment than the oil and gas industry. The biggest jump in overall energy investment was in the United States, where it was boosted by higher spending in upstream supply, particularly shale, but also electricity networks. The increase narrowed the gap between the United States and China, which remained the world’s largest investment destination.

Even though investments stabilized, approvals for new conventional oil and gas projects fell short of what would be needed to meet future global energy demand. Continued robust demand growth for oil and gas would require a sharp pick-up in approvals of new conventional upstream projects, Figure 2.

NPS = New Policies Scenario (current and future government policies, and increased energy efficiency)

SDS = Sustainable Development Scenario (accelerated energy transition to meet the Paris Agreement)

At the same time, there are few signs of the substantial reallocation of capital towards energy efficiency and cleaner supply sources that is needed to bring investments in line with the Paris Agreement and other sustainable development goals. In a separate report released earlier this month, the IEA found that the worldwide growth of renewable power capacity—including solar PV, wind, hydro, and bioenergy—stalled in 2018 after two decades of strong growth.

“Energy investments now face unprecedented uncertainties, with shifts in markets, policies and technologies,” said Dr Fatih Birol, the IEA’s Executive Director. “But the bottom line is that the world is not investing enough in traditional elements of supply to maintain today’s consumption patterns, nor is it investing enough in cleaner energy technologies to change course. Whichever way you look, we are storing up risks for the future.”

For the US shale sector, the investment landscape remains dynamic with the arrival at scale of the majors, but this is being offset by a more subdued outlook for most of the pure shale players, for whom the priority is now to live within their means. The IEA predicts that the fastest growth in upstream investment in 2019 is set to be in conventional projects, rather than in shale. Many of these conventional projects are in the offshore sector.

Even though decisions to invest in coal-fired power plants declined to their lowest level this century, the global coal power fleet continued to expand, particularly in developing Asian countries. The continuing investments in coal plants, which have a long lifecycle, appear to be aimed at filling a growing gap between soaring demand for power and a leveling off of expected generation from low-carbon investments—renewables and nuclear. Without carbon capture technology or incentives for earlier retirements, coal power and the high CO2 emissions it produces would remain part of the global energy system for many years to come.

The report also found that public spending on energy research, development and demonstration (RD&D) is far short of what is needed. While public energy RD&D spending rose modestly in 2018, led by the United States and China, its share of gross domestic product remained flat and most countries are not spending more of their economic output on energy research.

Source: IEA