Energy Institute releases Statistical Review of World Energy

4 July 2023

The Energy Institute (EI) and partners KPMG and Kearney released the 72nd annual edition of the Statistical Review of World Energy, presenting full global energy data for 2022.

The Statistical Review of World Energy was previously published by BP. Arguably, one of the world’s most important and credible sources of energy data, the Review has been providing comprehensive energy statistics since 1952. BP published the 71st edition of the Review in 2022. Beginning from this year, the Review is published by the Energy Institute (EI)—a chartered professional membership body for people who work in energy.

Some of the key themes that emerge from the 2022 data are:

- Post-Covid, transport fuel demand patterns continued to return, but with major variations across geographies and fuel types. China was a major outlier, in particular in terms of jet fuel remaining significantly below its pre-Covid level, due to its ‘zero Covid’ policy.

- The Ukraine conflict and curtailment of Russian supplies to Europe precipitated record international gas prices in Europe and Asia, and unprecedented shifts in global oil and gas trade flows.

- The strong pace of deployment of renewables in the power sector continued, driven by solar and wind. 2022 saw the largest ever increase in wind and solar new build capacity. Together they reached a record 12% share of power generation, with solar up 25% and wind up 13.5%.

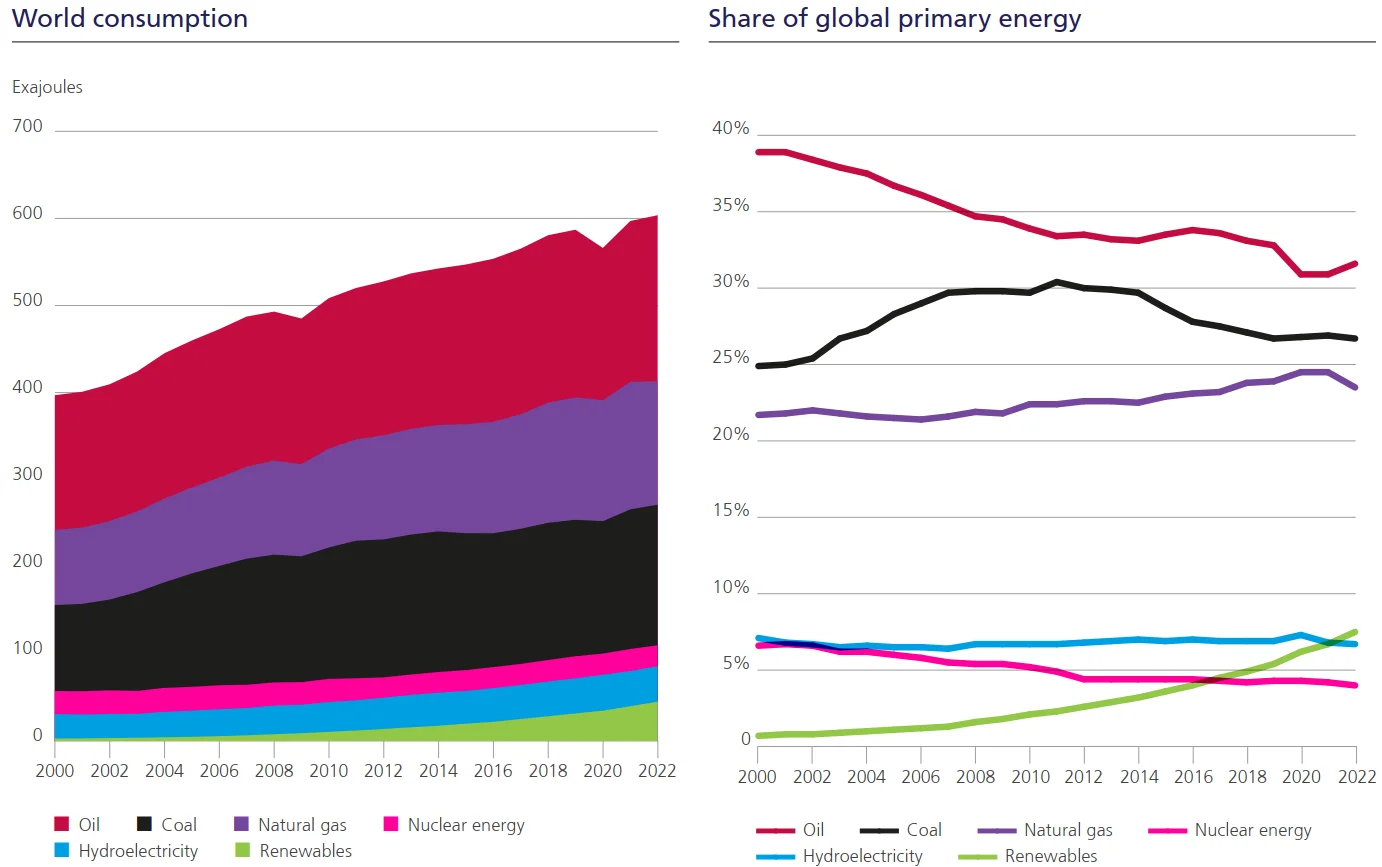

- Global primary energy consumption grew by around 1% in 2022, taking it to nearly 3% above the 2019 pre-Covid level. The dominance of fossil fuels was largely unchanged at almost 82% of total consumption.

- Global energy-related emissions continued to grow, up 0.8%, despite strong growth in renewables.

Renewables include solar, wind, geothermal, biomass, and waste

(Source: Energy Institute Statistical Review of World Energy 2023)

Primary energy—Primary energy demand growth slowed in 2022, increasing 1.1%, compared to 5.5% in 2021, and taking it to around 3% above the 2019 pre-Covid level. Consumption increased in all regions apart from Europe (-3.8%) and CIS (-5.8%). Renewables’ (including solar, wind, geothermal, biomass, and waste; excluding hydro) share of primary energy consumption reached 7.5%, an increase of nearly 1% over the previous year. Fossil fuels’ share of primary energy consumption remained steady at 82%.

Carbon emissions—CO2 emissions from energy use, industrial processes, flaring and methane (in CO2 equivalent terms) continued to rise to a new high growing 0.8% in 2022 to 39.3 GtCO2e, with emissions from energy use rising 0.9% to 34.4 GtCO2. In contrast, CO2 emissions from flaring decreased by 3.8% and emissions from methane and industrial processes decreased by 0.2%.

Oil—Brent crude oil prices averaged $101/bbl in 2022, its highest level since 2013. Oil consumption continued to increase, rising by 2.9 million barrels per day (b/d) to 97.3 million b/d, a smaller increase than was seen between 2020 and 2021. Consumption remained 0.7% below 2019 levels. Regionally, OECD consumption increased by 1.4 million b/d and non-OECD by 1.5 million b/d. Global oil production increased by 3.8 million b/d in 2022, with OPEC+ accounting for more than 60% of the increase. Among all countries, Saudi Arabia (1,182,000 b/d) and the USA (1,091,000 b/d), saw the largest increases.

Natural gas—Gas prices reached record levels in Europe and Asia in 2022, rising nearly threefold in Europe (TTF averaging $37/mmBtu) and doubling in the Asian LNG spot market (JKM averaging $34/mmBtu). US Henry Hub prices rose over 50% to average $6.5/mmBtu in 2022—their highest annual level since 2008. Global natural gas demand declined by 3% in 2022 dropping just below the 4 Tcm mark achieved for the first time in 2021. Its share in primary energy in 2022 decreased slightly to 24% (from 25% in 2021). Global gas production remained relatively constant compared to 2021.

LNG supply grew 5% (26 Bcm) to 542 Bcm in 2022, similar to 2021. LNG supply increases came mostly from North America (10 Bcm) and APAC (8 Bcm). All other regions made a positive contribution to LNG supply growth in 2022 (8 Bcm). The increase in global LNG demand was triggered by Europe (62 Bcm). Countries in the Asia Pacific region reduced their LNG imports by 24 Bcm and those in South & Central America by 11 Bcm.

Coal—Coal prices reached record levels in 2022, with European prices averaging $294/tonne and the Japan CIF spot price averaging $225/tonne (increases of 145% and 45% over 2021 respectively). Coal consumption continued to increase, rising 0.6% on 2021 to 161 EJ; the highest level of coal consumption since 2014. The growth in demand was largely driven by China (1%) and India (4%). Their combined growth of 1.7 EJ was sufficient to offset declines in other regions by 0.6 EJ. Coal consumption in both North America and Europe declined by 6.8% and 3.1% respectively. Global coal production increased by over 7% compared to 2021, reaching a record high of 175 EJ. China, India, and Indonesia accounted for over 95% of the increase in global production.

Electricity—Global electricity generation increased by 2.3% in 2022 which was lower than the previous year’s growth rate of 6.2%. Renewables (excluding hydro) met 84% of net electricity demand growth in 2022.

Wind and solar reached a record high of 12% share of power generation with solar recording 25% and wind power 13.5% growth in output. The combined generation from wind and solar once again surpassed that of nuclear energy. Coal remained the dominant fuel for power generation in 2022, with a stable share around 35.4%, marginally down from 35.8% in 2021. Natural gas-fired power generation remained stable in 2022 with a share of around 23%.

Source: Energy Institute