Bloomberg: Battery prices are falling again

28 November 2023

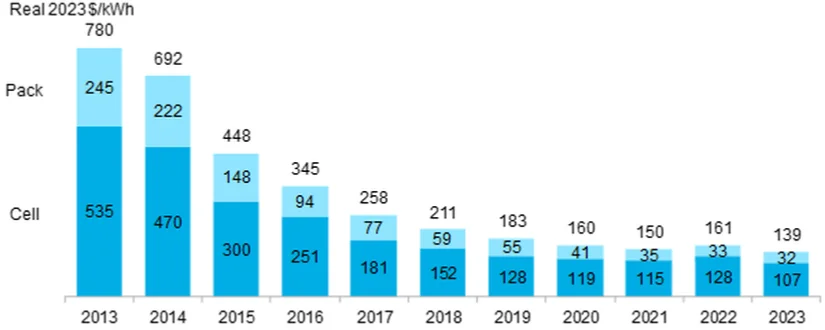

Following unprecedented price increases in 2022, battery prices are falling again this year, according to BloombergNEF’s annual lithium-ion battery price survey. Average battery pack prices fell to $139 per kWh this year, a 14% drop from $161/kWh in 2022.

Values are weighted averages across passenger EVs, commercial vehicles, buses, and stationary storage. Source: BloombergNEF

The main contributor to falling battery prices historically has been technological innovation. This hasn’t been the case in 2023. This year, the drop in battery prices is primarily attributed to lower raw material costs.

Prices of key battery metals—especially lithium—have fallen dramatically since January, due to significant growth in production capacity across all parts of the battery value chain. Demand expectations also played a role. Battery demand continued increasing year-on-year, but the second half of the year saw the rate of growth slow in certain EV markets, primarily due to rising borrowing costs and economic uncertainty, according to BloombergNEF.

China’s battery production alone exceeded global demand, an indicator of global oversupply. The utilization rate of battery cell manufacturing plants for major manufacturers was also lower this year than in 2022. Plants were not producing at their maximum theoretical capacity, in concert with a trend of some automakers scaling back their targets.

The BloombergNEF figures represent an average across multiple battery end-uses, including different types of electric vehicles, buses and stationary storage projects. For battery electric vehicle (BEV) packs, prices were $128/kWh on a volume-weighted average basis in 2023. At the cell level, average prices for BEVs were just $89/kWh. This indicates that on average, cells account for 78% of the total pack price. Over the last four years, the cell-to-pack cost ratio has risen from the traditional 70:30 split. This is partially due to changes to pack design, such as the introduction of cell-to-pack approaches, which have helped reduce costs.

On a regional basis, average battery pack prices were lowest in China, at $126/kWh. Packs in the USA and Europe were 11% and 20% higher, respectively. Higher prices reflect the relative immaturity of these markets, higher production costs, lower volumes, and the diverse range of applications.

The industry continues to switch to the low-cost lithium iron phosphate (LFP) cathode chemistry. These packs and cells had the lowest global weighted-average prices, at $130/kWh and $95/kWh, respectively. This is the first year that BloombergNEF’s analysis found LFP average cell prices falling below $100/kWh. On average, LFP cells were 32% cheaper than lithium nickel manganese cobalt oxide (NMC) cells in 2023.

Source: BloombergNEF