USDA: Renewable diesel production growth drastically impacts global feedstock trade

14 June 2024

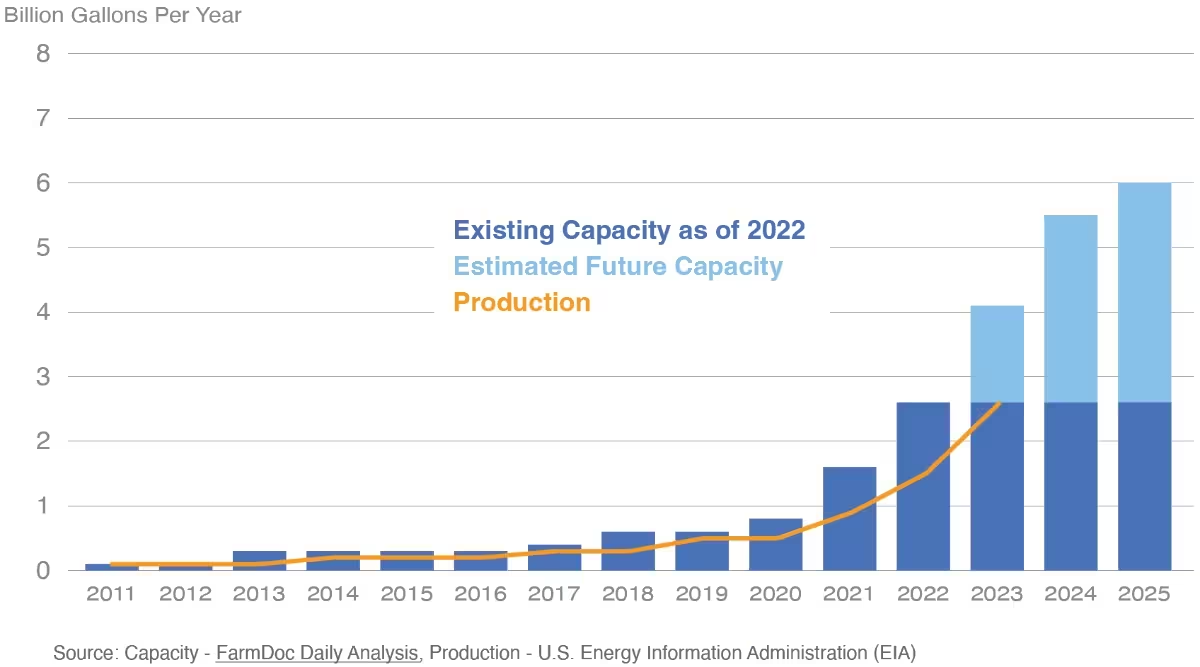

A new report by the US Department of Agriculture (USDA) finds that the sharp growth in US renewable diesel (RD) production is causing significant, market-altering shifts both domestically and to foreign feedstock trade.

The growth in RD production and production capacity is driven by federal and state policies aimed at reducing GHG emissions. These includes the Blender’s Tax Credit, which provides tax incentives for blending biomass-based diesel into the US diesel pool; the Renewable Fuel Standard (RFS); and the California Low-Carbon Fuel Standard (LCFS).

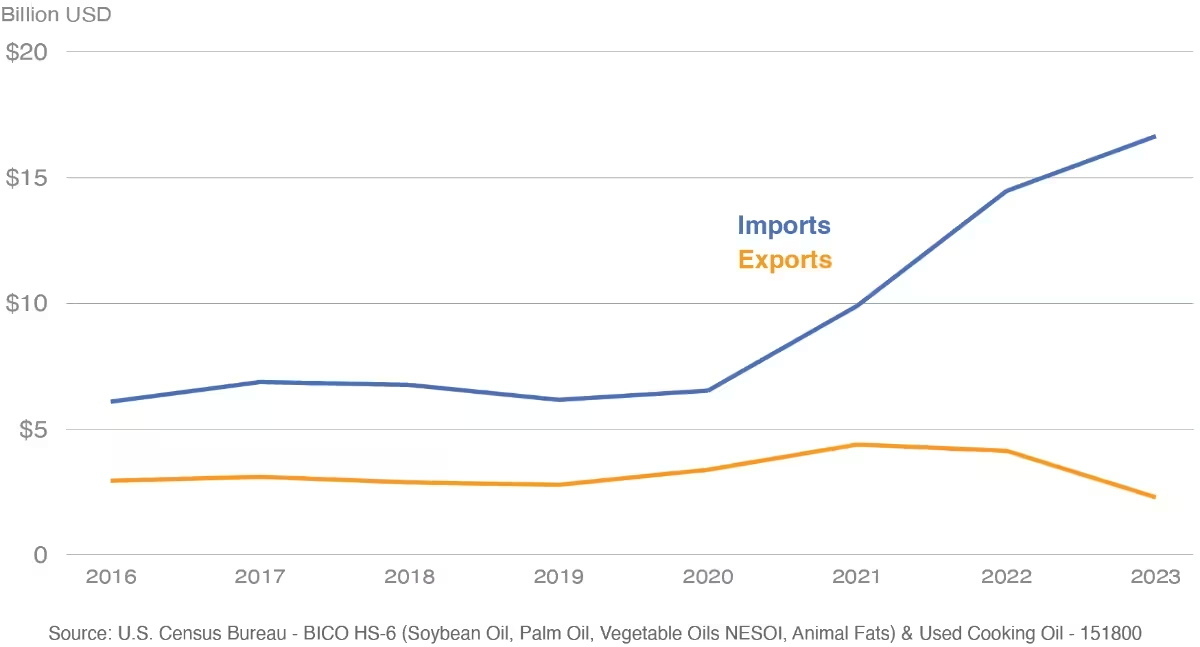

Renewable diesel, like biodiesel, is produced from the same renewable feedstocks such as vegetable oils, animal fats, and used cooking oil (UCO). To meet the growing demand, the United States is rapidly expanding imports of animal fats and vegetable oils to both use as feedstocks for renewable diesel production and to backfill other feedstocks, such ad soybean oil, that have been diverted to renewable diesel production.

US import values of all animal fats and vegetable oils, Figure 2, more than doubled from 2020 to 2023. One of the major drivers was UCO imports, which more than tripled in 2023 on higher imports from China.

Domestically, US soybean crush expanded to produce more oil, driven by high soybean oil prices fueling strong crush margins. While domestic demand grew, US soybean exports declined—the United States became a net soybean oil importer for the first time in 2023.

The USDA expects that US imports of animal fats and vegetable oils will continue to grow in tandem with biomass-based diesel production, in part due to an additional policy bump next year. Starting in January 2025, the federal government will transition from a blender’s tax credit—applicable to both domestically produced and imported biomass-based diesel—to a producer’s tax credit, which will only apply to biomass-based diesel that is produced in the United States. Thus, demand for biofuel imports is expected to drop substantially, driving even greater imports of fats and oils to US refineries to produce these biofuels domestically. During the past 5 years (2019-2023), biomass-based diesel imports averaged about one-fifth of production volumes, signaling a substantial opportunity for a bump in feedstock demand next year, further boosting a trade deficit that has been rapidly expanding, the USDA said.

Additionally, the Producer’s Tax Credit, coupled with the California LCFS, will heighten the demand for lower carbon-intensity feedstocks like tallow, UCO, and corn oil. Under the LCFS, west-coast market demand is stronger for feedstocks that provide greater carbon-emission reductions than virgin vegetable oils like canola and soybean oil. These policies will continue to pull available global feedstocks into the California renewable diesel market, and boost US import demand for feedstocks that make lower carbon-intensity biofuels that generate additional credits in the California market.

Source: US Department of Agriculture