USA: Fuels: California Low Carbon Fuel Standard (LCFS)

Introduction

California’s LCFS program was enacted through California’s AB32 Global Warming Solutions Act, which tasked state agencies to reduce GHG emissions from the transportation sector [6122].

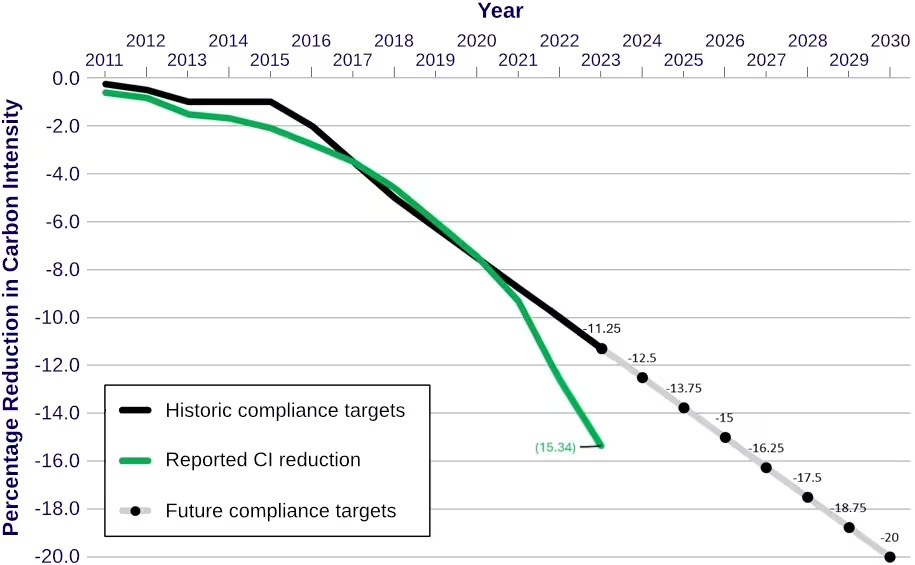

The LCFS sets annual carbon intensity (CI) standards, or benchmarks, which reduce over time, for gasoline, diesel, and the fuels that replace them. Carbon intensity is expressed in g-CO2/MJ and accounts for the complete life cycle GHG emissions of the fuel. Figure 1 summarizes the compliance targets to 2030 and reported CI reduction to 2022 [6123].

Applicability

Fuels covered by the LCFS include fossil fuels such as gasoline, diesel, compressed natural gas (CNG), liquefied natural gas (LNG), as well as alternative transportation fuels such as biofuel and biofuel blends, including biodiesel, ethanol and bio-CNG, bio-LNG, electricity, and hydrogen.

The LCFS regulation does not apply to alternative fuels that are not biomass‐based fuel or supplied in California with an aggregated quantity of less than 420 million MJ/year. Aviation gasoline, deficit‐generating fuel used in military tactical vehicles, and credit‐generating fossil CNG or fossil propane dispensed at a fueling station with total throughput of 150,000 gasoline‐gallons equivalent or less per year (until 2021 or 2024, respectively) are also exempt from the LCFS. While conventional jet fuel is exempt and does not produce deficits, alternative jet fuels can be used to generate LCFS credits. The LCFS regulation also does not apply to fuels used in interstate locomotives, ocean‐going vessels, and deficit‐generating fossil propane and CNG used in school buses purchased prior to January 1, 2020.

Entities

For fossil fuels used in transportation, the regulated parties are typically the producers in California or importers of fossil fuels to California. In the case of fossil natural gas (FNG), the regulated party is the entity that owns the fuel facility before the fuel is dispensed or the entity that owns the fueling equipment. For biofuels, the producers or importers of the biofuel can claim LCFS credits.

For electricity, the electric distribution utilities (EDUs) can opt in to claim LCFS credits for residential and non-residential EV charging and are subject to specific rules regarding the use of LCFS revenue. For public charging, the EV service provider (EVSP) or site host can opt in to claim credits in place of the EDUs. Fleet operators and business owners can also opt in to claim credits for private access charging for fleets and workplaces respectively.

CI Benchmarks

Credits and deficits are calculated using the carbon intensity benchmarks for gasoline and diesel fuel in each calendar year. These benchmarks equate to a 6.25% reduction in carbon intensity relative to 2010 in the 2019 compliance year, increasing linearly to a 20 percent reduction in 2030.

Credit and deficit generation is separated for gasoline and fuels intended to displace it (gasoline pool) and diesel and its substitutes (diesel pool). Credits generated under the gasoline pool and diesel pool can be used for compliance with either standard. The separate standards are meant to ensure that the program does not incentivize a shift from one fossil fuel to another as a compliance strategy.

Since conventional jet fuel is not subject to the LCFS regulation and does not generate deficits, jet fuel carbon intensity benchmarks are used specifically to calculate credits from alternative jet fuel. The jet fuel benchmarks are fixed at the 2010 baseline CI for conventional jet fuel, with a zero percent reduction in each year, until the benchmark for diesel substitutes declines below the CI baseline for jet fuel in 2023. The jet fuel benchmarks then mirror the benchmarks for diesel through 2030.

Figure 2 illustrates the benchmarks for gasoline, diesel and alternative jet fuel pools. Numerical values can be found in the regulation [6127].

Life Cycle Analysis

The CI includes the “direct” effects of producing and using the fuel, as well as “indirect” effects that are primarily associated with crop‐based biofuels. Two models are used to calculate the direct effects, which are the California Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (CA‐GREET) and Oil Production Greenhouse gas Emissions Estimator (OPGEE) models. To calculate the indirect effects, the Global Trade Analysis Project (GTAP) model was updated and the Agro‐Ecological Zone Emissions Factor (AEZ‐EF) model was created to supplement GTAP’s estimates of greenhouse gas emissions from various types of land conversions [6128].

Amendments to the LCFS regulation in 2018 replaced CA-GREET2.0 with the CA-GREET3.0 model and Tier 1 Simplified CI Calculators for LCFS fuel life cycle analysis. The CA-GREET3.0 model is used to generate the carbon intensities (CIs) of all fuel pathways, including Lookup Table pathways and applicant-specific Tier 1 and Tier 2 pathways. Amendments proposed in December 2023 would adopt the CA-GREET4.0 model along with changes to the Tier 1 calculators and the Lookup tables.

All crude oil coming into California refineries receives a single carbon intensity rating, calculated based on the average crude oil mix used in local refineries. The aim is to discourage crude oil “shuffling,” where the source of fuel covered under the regulation shifts without achieving any actual emission reductions. The average California crude CI rating is updated regularly and generates additional deficits if it rises above 2010 baseline values. The program does not award credits to fuel providers for reducing their CIs by shifting to lighter, lower CI crude oil, individually or as a group [6129].

Credit Generation

Overview

The market sets the price of credits based on how many are in circulation at a given time. As a result, prices can be volatile. To limit the impact of LCFS credit prices on end users, CARB put a $200 cap on credit prices in 2016 dollars, adjusted for inflation annually. The cap was $253.53 in 2023 [6130].

There are three ways to generate credits in the LCFS: through fuel pathways, through projects intended to reduce GHGs and by building ZEV fueling infrastructure.

Fuel Pathway Credits

Under fuel pathway‐based crediting, all transportation fuels need a carbon intensity score to participate in the LCFS, and the fuel type dictates which process is used to determine that CI. Providers of low carbon fuels used in California transportation generate credits by obtaining a certified CI and reporting transaction quantities on a quarterly basis. Credits are calculated relative to the annual CI benchmark and will undergo verification after credit generation.

LCFS credits (or deficits) for each fuel or blendstock for compliance period are calculated as follows:

CreditsXDi [MT] = (CIXDstandard - CIi/EERXDi) × EXDdisplaced × 1 t CO2e/106 g CO2e(1)

where:

CIXDstandard is the average carbon intensity requirement of either gasoline (XD = “gasoline”), diesel (XD = “diesel”), or jet fuel (XD = “jet”) for a given year,

CIi is the carbon intensity of the fuel or blendstock, measured in gCO2e/MJ, determined by a CA-GREET pathway or a custom pathway,

EERXDi is the dimensionless Energy Economy Ratio (EER) relative to gasoline, diesel, or jet fuel, Table 1,

EXDdisplaced is the total quantity of gasoline, diesel, or jet fuel energy displaced, in MJ, by the use of an alternative fuel (EXDdisplaced = Ei × EERXD),

Ei is the energy of the fuel or blendstock, in MJ.

Energy densities and conversion factors for LCFS fuels and blendstocks can be found in the regulation [6131].

| Light/Medium-Duty Applications (Fuels used as gasoline replacement) | Heavy-Duty/Off-Road Applications (Fuels used as diesel replacement) | Aviation Applications (Fuels used as jet fuel replacement) | |||

|---|---|---|---|---|---|

| Fuel/Vehicle Combination | EER Values Relative to Gasoline | Fuel/Vehicle Combination | EER Values Relative to Diesel | Fuel/Vehicle Combination | EER Values Relative to Conventional Jet |

| Gasoline (incl. E6 and E10) or E85 (and other ethanol blends) | 1 | Diesel fuel or Biomass-based diesel blends | 1 | Alternative Jet Fuel | 1 |

| CNG/ICEV | 1 | CNG or LNG (Spark-Ignition Engines) | 0.9 | ||

| CNG or LNG (Compression-Ignition Engines) | 1 | ||||

| Electricity/BEV, or PHEV | 3.4 | Electricity/BEV or PHEV Truck or Bus | 5.0 | ||

| Electricity/Fixed Guideway, Heavy Rail | 4.6 | ||||

| Electricity/Fixed Guideway, Light Rail | 3.3 | ||||

| On-Road Electric Motorcycle | 4.4 | Electricity/Trolley Bus, Cable Car, Street Car | 3.1 | ||

| Electricity Forklifts | 3.8 | ||||

| eTRU | 3.4 | ||||

| eCHE | 2.7 | ||||

| eOGV | 2.6 | ||||

| H2/FCV | 2.5 | H2/FCV | 1.9 | ||

| H2 Fuel Cell Forklifts | 2.1 | ||||

| Propane | 1.0 | Propane | 0.9 | ||

| BEV = battery electric vehicle, PHEV= plug-in hybrid electric vehicle, FCV = fuel cell vehicle, ICEV = internal combustion engine vehicle. | |||||

As noted above, electricity used for transportation can generate LCFS credits. This includes electricity used to charge BEVs and PHEVs, for fixed guideway systems, electric forklifts, electric transport refrigeration units (eTRU), electric cargo handling equipment (eCHE) and electric power for ocean-going vessels (eOGV). Additional credits are available if the electricity has a lower CI than the grid average or if smart charging is used to take advantage of periods when excess renewable electricity is available. Additional credits are also available for hydrogen if smart electrolysis is used for its generation.

The fuel type dictates how the CI value is determined. The CI value can be determined from a lookup table, a Tier 1 application or a Tier 2 application.

Lookup Table pathways have CI values predetermined by CARB using industry‐wide average inputs, or conservative assumptions. Most of the fuels in the Lookup Table do not require an application, and those that do have few requirements and a very streamlined approval process [6132].

The Tier 1 pathway application process is for the most common low carbon fuels, and applicants use a Simplified CI Calculator to determine their site‐specific fuel production and transport emissions. Under Tier 1, most emissions from feedstock production are based on standard inputs, but the calculators have some flexibility to accommodate user‐defined process energy inputs [6133].

The Tier 2 application process is designed for innovative, next‐generation pathways, which may use unique feedstocks or include advanced technologies like Carbon Capture and Sequestration. Tier 2 fuels include Alternative jet fuel, and any other pathway that is not eligible to use the Lookup Table or Tier 1 process. Applicants for these pathways can fully customize the California GREET model to accurately determine their site‐specific CI [6134].

The CI of numerous fuel pathways have been certified by CARB [6135]. Low carbon fuels produced from waste oils and crop residues have the lowest CI intensity but supplies of these feedstocks are limited. The expansion of the LCFS proposed in 2024 would undoubtedly increase the amount of crop-based fuels and make the program less sustainable [6136]. Under a modified proposal, CARB would limit LCFS credits for fuel produced from virgin soybean oil and canola oil to 20% of annual biomass-based diesel reported on a company-wide basis.

Project Credits

Under project‐based crediting, actions to reduce GHG emissions in the petroleum supply chain, and Carbon capture and sequestration (CCS) using Direct Air Capture can qualify for credits. Crediting for projects is based on life cycle emission reductions, and credits are issued after the reported reductions are verified. Project-based crediting is available for four categories of projects:

- Credits for producing and transporting crudes using innovative methods

- Low-complexity/low-energy-use refinery credit

- Refinery investment credit program

- Renewable hydrogen refinery credit program

Credits for producing and transporting crudes using innovative methods are available for crude oil producers or transporters using one or more of the following technologies:

- Solar steam generation where the steam is used onsite at the crude oil production or transport facilities,

- Onsite CCS at the crude oil production or transport facilities,

- Solar or wind electricity produced and consumed onsite or provided directly to the facility but not through a utility owned transmission or distribution network,

- Onsite Solar heat generation and use,

- Renewable natural gas (RNG) or biogas energy supplied directly to the facility.

The low-complexity/low-energy-use refinery credit is available to a refinery that has a Modified Nelson Complexity Score equal to or less than 5 and has a total annual energy use equal to or less than 5 million MMBtu.

Refinery investment credits are available for refineries that reduce greenhouse gas emissions for the following project types:

- CO2 capture at refineries, or at hydrogen production facilities that supply hydrogen to refineries, and subsequent geologic sequestration,

- Use of renewable or low-CI electricity supplied behind the meter,

- Use of lower-CI process energy such as biomethane, renewable propane, and renewable coke, to displace fossil fuel,

- Electrification at refineries that involves substitution of high carbon fossil energy input with grid electricity,

- Process improvement projects that deliver a reduction in baseline refinery-wide greenhouse gas emissions.

Under the renewable hydrogen refinery credit program, a refinery may receive credit for greenhouse gas emission reductions from the production of CARB or diesel fuel that is partially or wholly derived from renewable hydrogen. Renewable hydrogen can be produced from various feedstocks including RNG, renewable electricity or syngas from biomass.

In addition to the CCS credits mentioned above, CCS can yield credits for:

- Alternative fuel producers, refineries, and oil and gas producers that capture CO2 on-site and geologically sequester CO2 either on-site or off-site.

- An entity that employs direct air capture to remove CO2 from the atmosphere and geologically sequester the CO2. If CO2 derived from direct air capture is converted to fuels, it is not eligible for project-based CCS credits but may be available for fuel pathway certification.

ZEV Fueling Infrastructure Credits

To provide additional incentives for the growth of ZEVs, the LCFS includes a provision to allow credits to be generated through the installation of hydrogen refueling stations and DC fast chargers. The LCFS will credit eligible stations based on the capacity of the station to deliver fuel once the station is fully utilized. While infrastructure credits will decrease as a station/charger reaches full utilization, this is offset by fuel pathway credits generated for the fuel dispensed, Figure 3. Hydrogen refueling infrastructure (HRI) crediting is limited to 15 years and fast charging infrastructure (FCI) to 5 years [6137].