ACEA calls for CO2 penalty relief for 2025 for cars and vans

24 February 2025

The European Automobile Manufacturers’ Association (ACEA) has issued another call on the EU authorities to provide a penalty relief for non-compliance with the mandatory 2025 CO2 emission targets for cars and vans, as the industry is faced with a “sluggish demand in zero-emission vehicles” (ZEV). Without such relief, the available compliance strategies will have a “detrimental impact on the competitiveness of the EU automotive industry and its ability to sustain jobs,” ACEA said in a press release.

Under the current regulatory provisions, automakers have the following compliance strategies:

- Pay penalties estimated at around €16 billion industry-wide. Even though the penalties are due to be after 2025 (after calculation and verification by the European Environment Agency and European Commission in 2026), companies would still need to make financial settlements, meaning this money cannot be used for re-investment.

- Limit production and sales of internal combustion engine (ICE) vehicles, possibly leading to factory closures, in order to average out the lower number of ZEVs placed on the market and thus meet the OEM-specific CO2-reduction targets.

- Pool with other manufacturers leading to payments to competitors, including non-EU manufacturers, hence resulting in a loss for the European industry.

- Sell ZEVs below market price to support overall production volumes, which will undermine manufacturers’ profitability and distort the second-hand market for ZEVs. Further price reductions will be challenging, as manufacturers have already been selling battery electric vehicles (BEV) at a loss.

ACEA is asking EU policy makers to consider two alternative compliance options with the CO2 emission mandates: a phase-in of 90% for 2025 and 95% phase-in for 2026 or introduction of an average compliance mechanism for years 2025-2029.

ACEA argues that the key issue is the lack of demand for BEVs. The most important factors that influence consumer demand include the BEV purchase price, insufficient driving range, concerns about battery lifetime, fear of increases in electricity prices, and the availability of public charging stations.

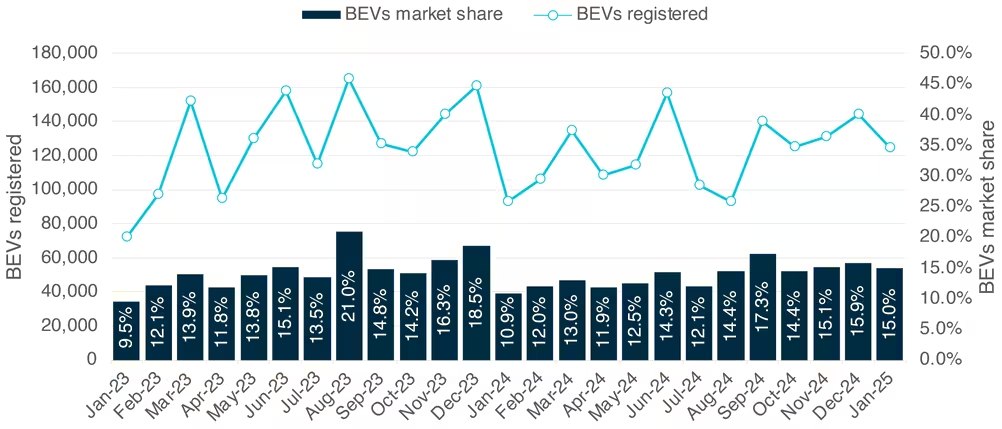

Despite the large number of models offered by the auto industry, the market share for BEVs in 2024 was below 14%. The demand remained stable over 2023-2024, with no ‘hockey stick’ growth curve that was expected, ACEA noted. The market share for BEVs over the past years has remained largely stable and failed to reach the 25-30% market share forecast several years ago.

(Source: ACEA)

Without flexibility, 2025-2026 could become a regulatory cliff-edge, forcing carmakers into extreme short-term actions such as steep price cuts or excessive EV supply surges, according to ACEA. This could destabilize pricing, create unsustainable discounting strategies, and undermine financial stability, which would have a negative impact in the overall automotive industry.

Current EU regulations require that manufacturers reduce their fleet-average CO2 emissions by 15% by 2025, relative to a 2021 baseline. This target increases to 55% for cars and 50% for vans by 2030. The non-compliance penalty is €95 per car and €120 per van for each g/km CO2 exceeding the target.

Source: ACEA