Conference report: SAE COMVEC 2025

26 September 2025

The SAE International’s COMVEC conference was held on September 16-19, 2024, in Schaumburg, Illinois, United States. The COMVEC forum facilitates the exchange of information on research and technology among the commercial vehicle industry, including the on-highway, off-highway, and defense sectors. The COMVEC formula includes keynote speeches and discussion panels. While no proceedings are published from the conference, this year program also included four Journal Sessions with presentations based on manuscripts accepted for publication in the SAE International Journal of Commercial Vehicles. The conference was attended by about 600 participants—including many executive level attendees—mainly from North America and Europe. The conference also included an exhibition for commercial vehicle manufacturers and their suppliers.

The conference was opened by a keynote address by John Rich, the CTO of Paccar, who described the regulatory and economic landscape faced by the industry. For the first time ever, the US Environmental Protection Agency (EPA) initiated a deregulation process, where emission regulations for engines and vehicles are being withdrawn or relaxed. The main target of deregulation are greenhouse gas emissions—under the proposed rule to rescind the GHG Endangerment Finding, all GHG emission standards for light-, medium-, and heavy-duty vehicles and engines in the United States would be repealed. In the absence of GHG emission regulations, which impose implicit mandates for alternative, zero tailpipe emission powertrains, the decarbonization of transportation in the United States would no longer be driven by government policy and the future mix of powertrain technologies—such as diesel, BEV, or PHEV—would be determined by their utility for the users and by market forces.

The EPA has not yet taken any formal steps in regards to emission standards for criteria pollutants. However, the agency has indicated that it intends to reevaluate the 2027 NOx emission standards for heavy-duty engines.

For more than 30 months, the trucking industry has been in a freight recession, resulting in depressed sales of heavy-duty engines and commercial vehicles. If the EPA 2027 emission standards are not delayed or relaxed, the new emission requirements would trigger a pre-buy of model year 2026 engines, providing a short-term benefit for engine and vehicle manufacturers.

The keynote also addressed new, digital technologies, such as software defined vehicles, self driving technologies, connectivity, and machine learning (AI) driving innovation. These highly hyped technologies carry a lot of promise, but are very complex and remain difficult to implement and to turn a profit for commercial vehicle manufacturers. Several companies that tried to build software defined vehicles failed, underestimating the challenges from the very high level of complexity.

Low-Carbon Transportation. Most discussion panels and presentations on alternative powertrains focused on electric and hybrid vehicles. Compared to the last year’s event, much less attention was devoted to hydrogen propulsion.

In the absence of government mandates, hydrogen vehicles are unlikely to be adopted in the United States. While engine manufacturers can develop hydrogen engines—combustion or fuel cell—the number of prospective customers interested in the technology is marginal. As commercial hydrogen is made from natural gas, the switch to H2 fueled vehicles would not reduce fossil fuel use or emissions. Low-carbon hydrogen, so-called green hydrogen, has the potential to reduce fossil fuels use but it is not available as a commercial product and its economic viability remains highly uncertain.

The electric vehicle market, on the other hand, is expected to grow, even without government mandates and subsidies. Light-duty vehicles are being (slowly) electrified, with a reversion to HEV and PHEV, due mainly to consumer acceptance problems. Among commercial vehicles, the medium duty segment is mostly well-suited to electrification and can be a fast follower to light-duty vehicles [C. Atkinson, Ohio State U.]. As of December 2024, there were about 52 thousand commercial electric vehicles on US roads, 47 thousand of which were cargo vans [J. Lund, NASEO].

Among heavy-duty vehicles, diesel will remain the dominant type of powertrain. In North America, 82% of 2040 powertrain mix is expected to be diesel, according to ExxonMobil [A. Garrison]. However, some heavy-duty applications may be well suited for electric vehicles, such as return-to-base operation with overnight charging. The school bus, for example, is a perfect application for electric propulsion.

These trends were confirmed in the COMVEC exhibition area, where the only BEV on display was a school bus (by International), while the heavy-duty trucks on display (Paccar, International) were powered by conventional diesel engines.

User experience with electric trucks was discussed in discussion panels with the participation of representatives from the freight industry [R. Kocher, Knight Transportation]. While in some respects, BEVs can perform better than diesel and driver experience with BEVs has been very positive, there are several challenges that prevent truck operators from buying electric vehicles:

- The cost of electric technology remains high, in terms of both the initial investment and the total cost of ownership (TCO), while the residual value of BEVs is uncertain. Wider-scale EV adoption depends on grants, subsidies, and incentives.

- Truck charging infrastructure—At most locations, the existing electrical grid does not have sufficient capacity to support the installation of multiple high power chargers, which makes scaling up EV truck fleets problematic.

- Evolution of charging technology and standards creates uncertainty in regards to the longer term compatibility of older EV trucks with future infrastructure.

- High vehicle weight and low cargo capacity—PHEV trucks may have a potential, but the weight of the vehicle must stay where trucks are today. Even modern diesel trucks are creeping up in weight due to new components and larger aftertreatment systems.

- Electric trucks are not suitable for rental applications, there is no customer demand [M. Willy, Paccar Leasing].

- Fleets are not willing to pay extra for low emission products. A small group of customers, mostly outside of the transportation industry, can do it for the purpose of their reputation, but it is only a small premium.

- Insurance companies are reluctant to underwrite policies to cover electric trucks.

Official decarbonization policies still remain in place in the European Union, however, the European electric and hydrogen truck ambition is not supported by adequate infrastructure development. It was noted at some discussion panels that the EU electricity generation has been declining for several years, a trend hardly compatible with the promotion of electric mobility, while the IEA has recently reduced its 2030 low-carbon hydrogen production outlook by ~25% compared to the last year.

Engines and Powertrains. Engine manufacturers are ready to meet the EPA 2027 low NOx emission standards, as well as the somewhat less stringent Euro VII requirements. However, no presentations were given on the choice of emission technology. From earlier announcements, it appears that the prevailing approach in North America will involve the use of electric heaters in the aftertreatment system (Cummins, Paccar) and an increased volume of the SCR catalyst. In Europe, most engines are expected to use a light-off SCR catalyst and dual-dosing urea systems, rather than exhaust heating. Several speakers indicated that in the longer term, hybrid trucks (HEV, PHEV) may be the winning solution [J. Rich, Paccar].

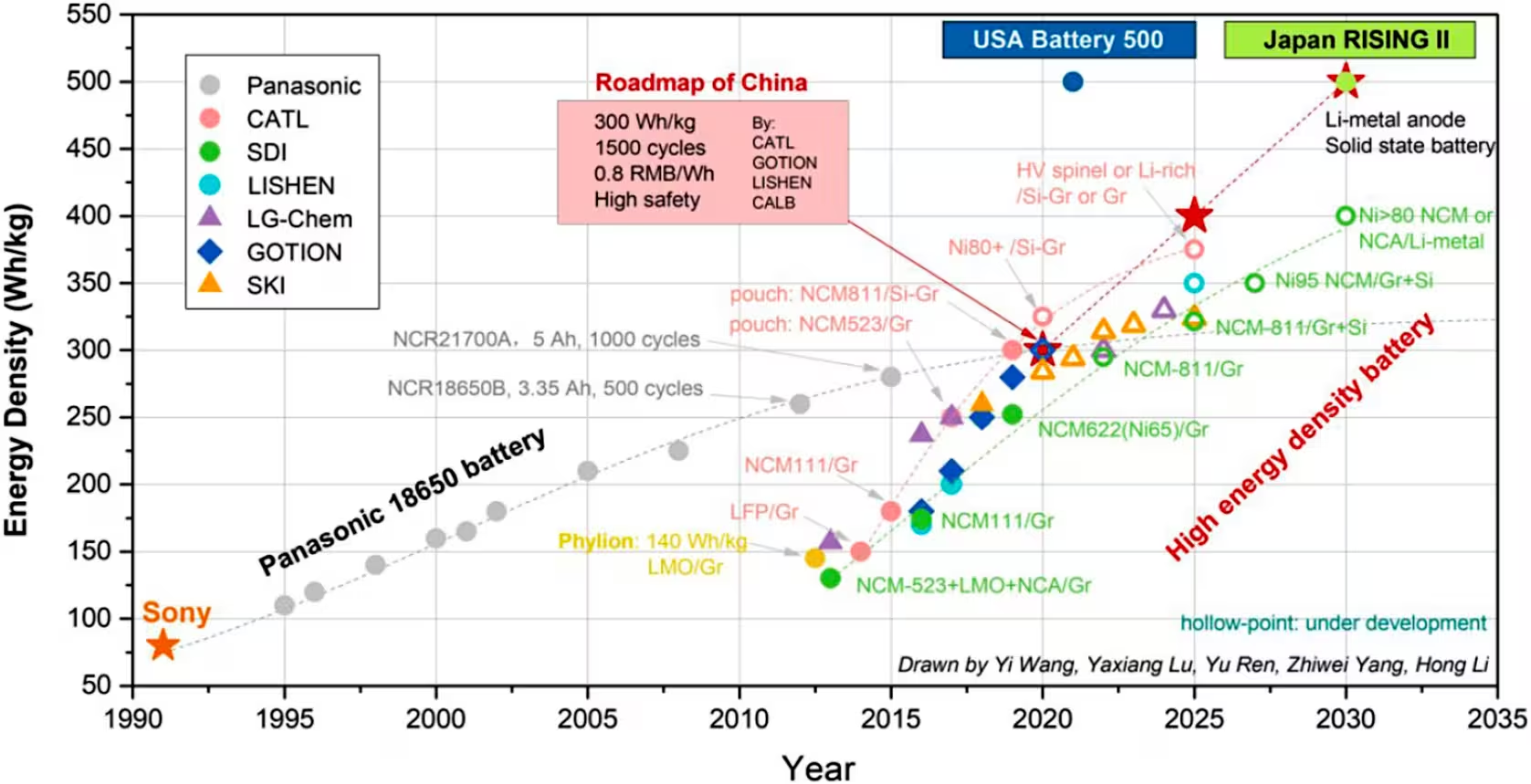

Several powertrain-related talks discussed batteries and battery charging technologies. EV batteries were also the subject of the SAE Buckendale Lecture given by Professor Anna Stefanopoulou [University of Michigan]. The presentation covered a range of battery topics, from manufacturing to the end of life. Since the 1990s, both the battery energy density (Figure 1) and the battery lifetime have seen an impressive improvement. At the end of warranty (EoW), the average EV battery pack has still about 50 kWh of usable battery energy (UBE), which allows for a 164 miles range—sufficient to meet 93% of vehicle trips in the United States.

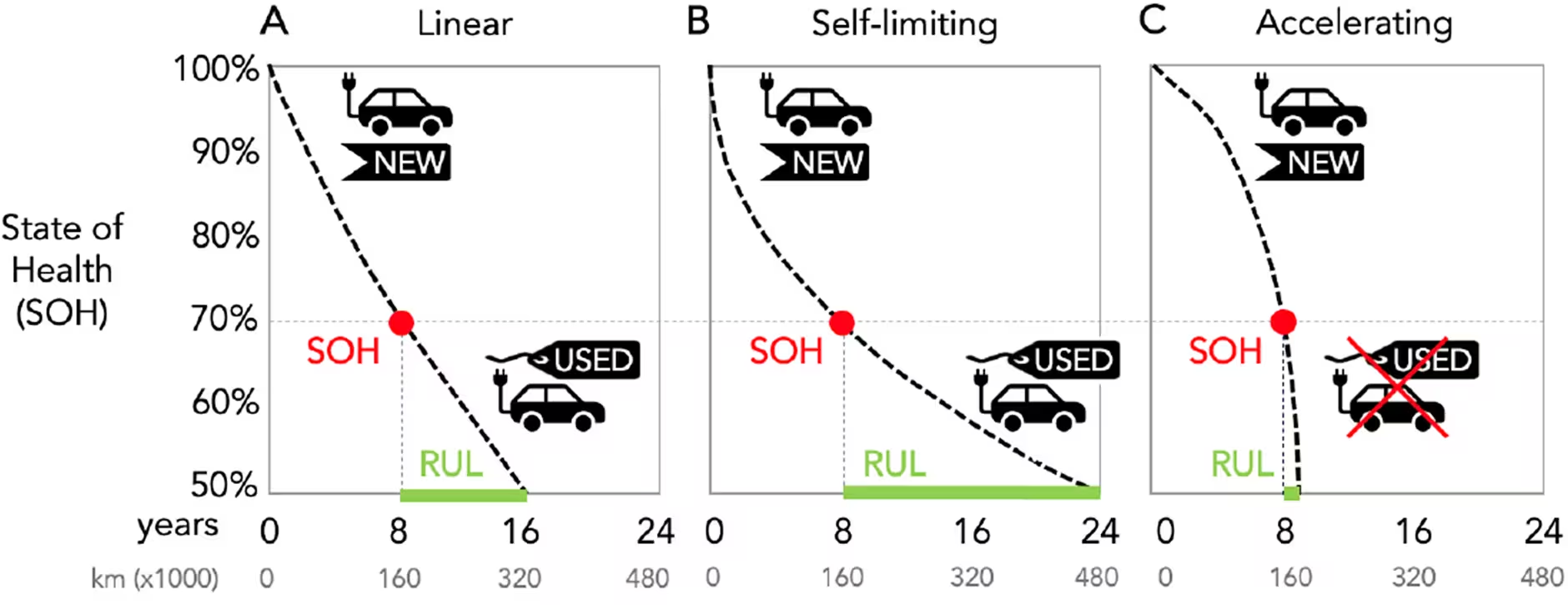

However, the battery remaining useful life (RUL) and therefore the resale value of a used BEV is still uncertain for the vehicle user. While the EU Battery Passport as well as the California Air Resources Board (CARB) regulations require a dashboard indicator of the battery state of health (SOH), different batteries may show different degradation trends (Figure 2) that are not adequately described by the SOH parameter alone.

* * *

The next COMVEC conference will be held again in Schaumburg, Illinois—the event is scheduled for 29 September - 1 October 2026.

Conference website: comvec.sae.org