IEA: Oil and gas industry facing the “Red Queen Syndrome”

19 September 2025

The average rate at which oil and gas fields’ output declines over time has significantly accelerated globally, largely due to higher reliance on shale and deep offshore resources, meaning that companies must work much harder than before just to maintain production at today’s levels, according to a new report by the International Energy Agency (IEA).

The oil and gas industry needs to run fast to stand still, the IEA said—a phenomenon often described as the Red Queen Syndrome. Nearly 90% of annual upstream oil and gas investment since 2019 has been dedicated to offsetting production declines rather than to meet demand growth. Investment in 2025 is set to be around USD 570 billion, and if this persists, modest production growth could continue in the future.

The IEA analysis reveals that the global average annual observed post‑peak decline rate is 5.6% for conventional oil and 6.8% for conventional natural gas. This varies widely by field type: supergiant oil fields decline by an average of 2.7% annually, while the average for small fields is more than 11.6%. Onshore oil fields decline more slowly, by an average of 4.2% per year, than those located deep offshore at 10.3%.

Alongside the observed decline rates that are derived from field production histories, the IEA analysis estimates the natural decline rates that would occur if all capital investment were to stop and shows that the natural decline rates of oil and gas fields are becoming steeper. In 2010, if all capital investment in existing sources of oil and gas production were to cease, natural decline rates would have led to a 3.9 million barrels per day mb/d annual drop in oil production and 180 billon cubic meters (bcm) annual drop in gas production. Today, in the absence of investment, global oil production would fall by 8% per year on average over the next decade, or around 5.5 mb/d each year, while natural gas output would fall by an average of 9%, or 270 bcm, each year.

The composition of oil and gas production has changed rapidly in recent years with the notable rise of tight oil and shale gas. Most unconventional sources of oil and gas production generally exhibit much faster decline rates than conventional types. If all investment in tight oil and shale gas production were to stop immediately, production would decline by more than 35% within 12 months and by a further 15% in the year thereafter. Shale plays in the United States are also becoming “gassier,” raising overall decline rates as oil-rich fields mature.

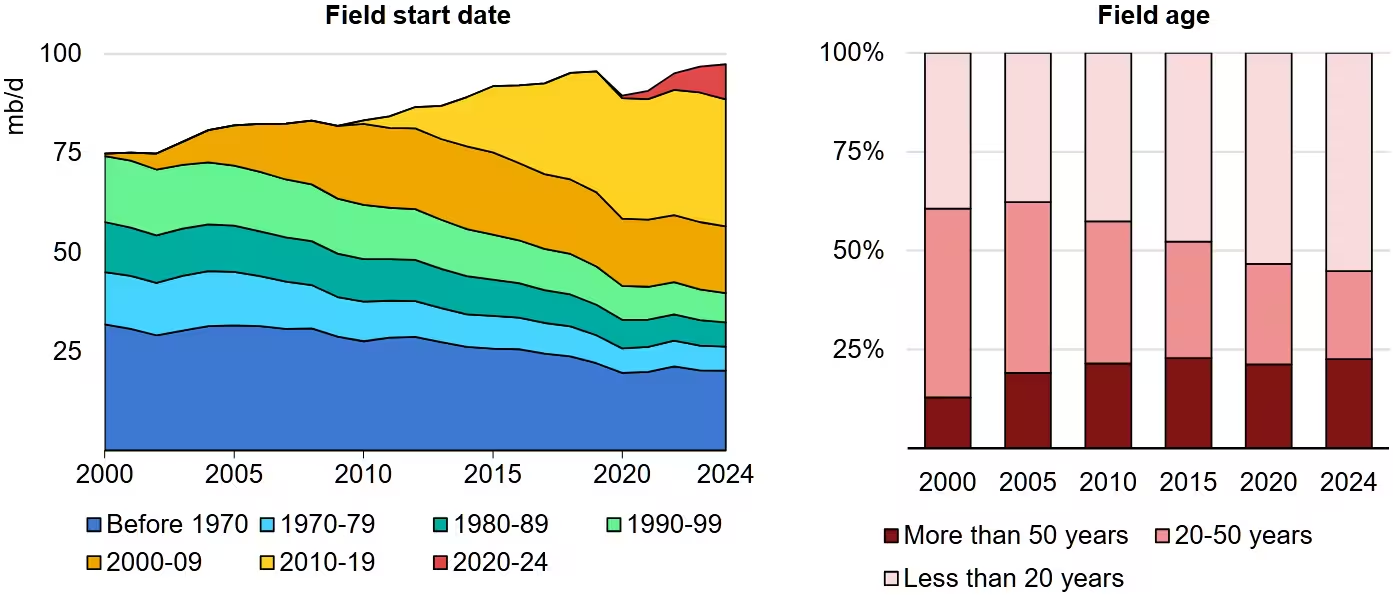

In 2024, more than half of oil production was from fields that are less than 20 years old and one-quarter was from fields older than 50 years. Output shares from both of these categories have risen significantly in recent years. For the newer field category, the increase reflects the rise of tight oil and unconventional NGLs. For older fields it highlights the enduring importance of longstanding conventional fields with low marginal costs that have seen recent development programs to boost production.

The oil production volumes in the chart include crude oil and natural gas liquids (NGL)

(Source: IEA, CC BY 4.0)

For fields in the 20-50 year old range, production declines in recent years reflect that the most prolific fields were developed in the 1970s or earlier, and that subsequent exploration and developments were generally smaller finds and often had higher decline rates. For example, many of the fields developed in the 1980s and 1990s were in Europe and US offshore areas which tend to have high decline rates, thus their current contributions are relatively smaller.

The IEA analysis draws on production data from around 15,000 oil and gas fields from around the world.

In the past, the IEA had issued several warnings about insufficient levels of investment in energy projects, raising concerns about the long-term adequacy of world’s energy supply. In the recent years, however, the agency became an advocate of climate action and released several reports and analyses that have downplayed investment in fossil energy.

In July 2025, the United States threatened to abandon the IEA if the organization does not return to forecasting energy demand without strongly promoting green energy. “We will do one of two things: we will reform the way the IEA operates or we will withdraw,” US Energy Secretary Chris Wright has told Bloomberg. “My strong preference is to reform it.”

Source: IEA