IEA releases World Energy Outlook 2025

12 November 2025

The International Energy Agency (IEA) released its World Energy Outlook 2025 (WEO-2025) that details global energy trends, carbon emissions, and energy security. The report presents scenario-based analysis of the future global energy system, including conventional and renewable energy.

“Energy is at the heart of today’s geopolitical tensions, with traditional risks to fuel supply now accompanied by restrictions affecting supplies of critical minerals”

WEO-2025

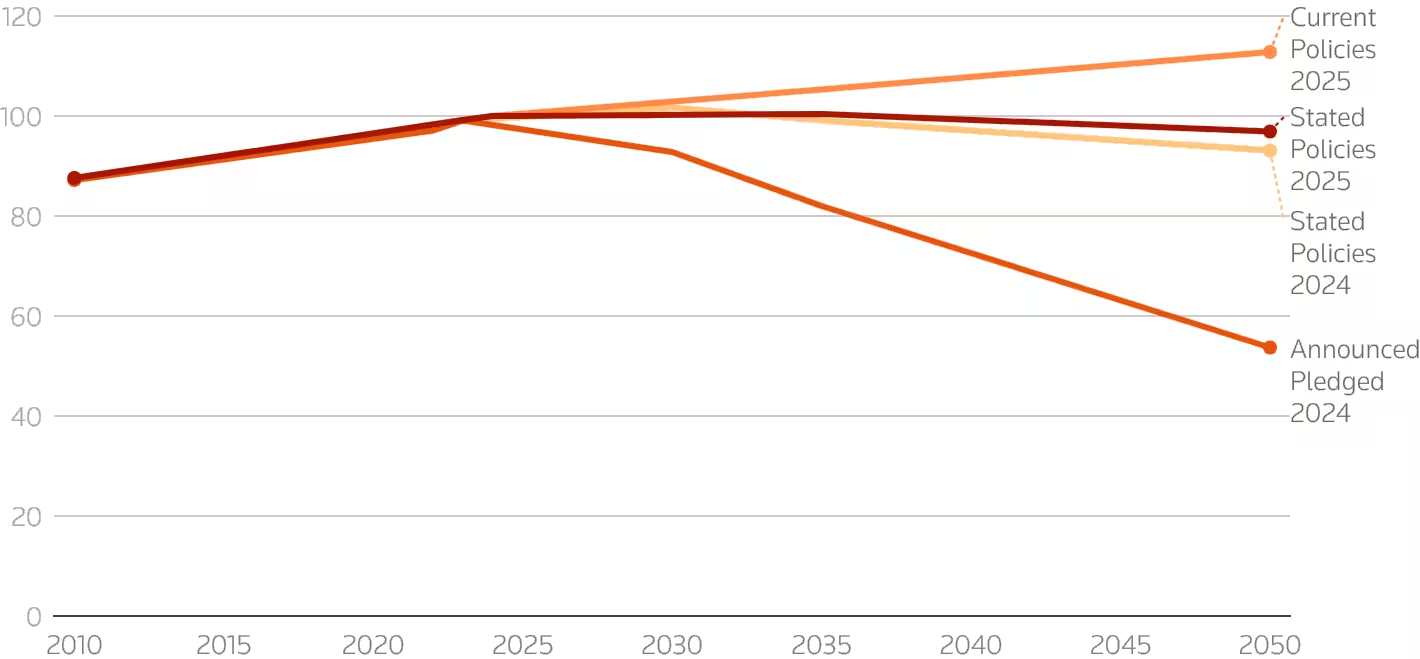

The report includes three main scenarios:

- The Current Policies Scenario (CPS) considers government policies and regulations that are already in place

- The Stated Policies Scenario (STEPS) considers a broader range of policies, including those that have been considered or formally put forward but not yet adopted

- Net Zero Emissions by 2050 Scenario (NZE) describes a pathway to reduce global energy-related CO2 emissions to net zero by 2050

Under the Current Policies Scenario, oil demand continues to increase, reaching 113 million barrels per day (mb/d) by 2050, up around 13% from 2024 consumption. Global energy demand would climb by 90 EJ by 2035, a 15% increase from present levels.

(Source: Reuters | Data: IEA)

The above outlook marks a departure from several previous years, when the IEA advocated rapid transition to renewable energy, expected that oil would peak some time this decade, and downplayed oil & gas investment. In WEO-2025, IEA has restored its CPS scenario, which had been removed from several prior reports that were based on the STEPS scenario instead. In September, IEA also warned about accelerated decline of oil and gas fields’ output and the need for continued investment in fossil energy. This change in direction occurred as the United States—the largest IEA contributor—has threatened to abandon the group if IEA would not return to objectively forecasting energy demand rather than promoting green energy.

The WEO-2025 analysis also shows that the world is falling short on the climate change goals it set for itself. With climate risks rising, the world is surpassing 1.5°C of warming in any scenario, including those with very rapid emissions reductions. The emissions trajectory in the CPS scenario is consistent with warming of almost 3°C by 2100, whereas lower levels of emissions in the STEPS scenario keep this to around 2.5°C, slightly higher than the 2024 version of the STEPS.

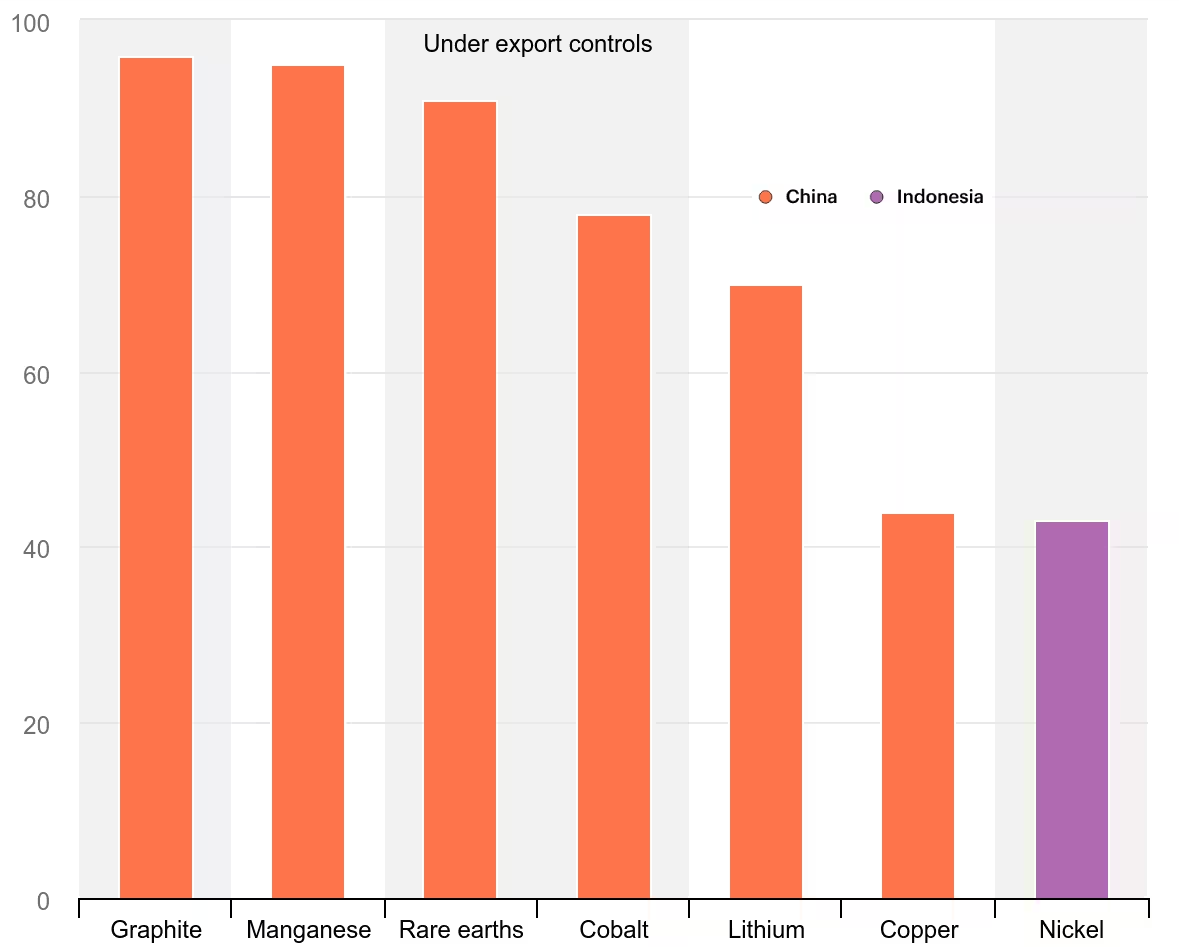

A large part of the report is devoted to the supply chains of critical minerals and metals. The supply risks of these materials—a new dimension to energy security—have been underscored by China’s export controls on rare earth elements and battery components and technologies. The key risk for critical minerals is high levels of market concentration, states WEO-2025. A single country—in most cases China—is the dominant refiner for 19 out of 20 energy-related strategic minerals, with an average market share of around 70%. As of November 2025, more than half of these strategic minerals are subject to some form of export controls.

(Source: IEA)

China is also the top refiner for many strategic minerals used in high-tech, aerospace, and defense-related industries, including gallium, silicon, tellurium, antimony, germanium, indium, tantalum, molybdenum, titanium, vanadium, tungsten, chromium, and zirconium.

Source: IEA