IEA releases Oil 2019—a global oil market forecast through 2024

11 March 2019

The International Energy Agency (IEA) released Oil 2019, a global oil market analysis and forecast through 2024. The IEA predicts the United States will drive global oil supply growth over the next five years thanks to its shale industry, triggering a rapid transformation of world oil markets. By 2024, oil exports from the United States will overtake Russia and close in on Saudi Arabia, bringing greater diversity of supply.

While global oil demand growth is predicted to ease, in particular as China’s economy slows down, it still increases at an annual average of 1.2 million barrels per day (mb/d) to 2024, representing and average annual 2018-2024 growth rate of 1.2%. Petrochemicals and jet fuel remain the key drivers of oil demand growth (+2.6% and +1.9% per annum, respectively), particularly in the United States and Asia, more than offsetting the slowing growth in gasoline consumption (+0.7% per annum).

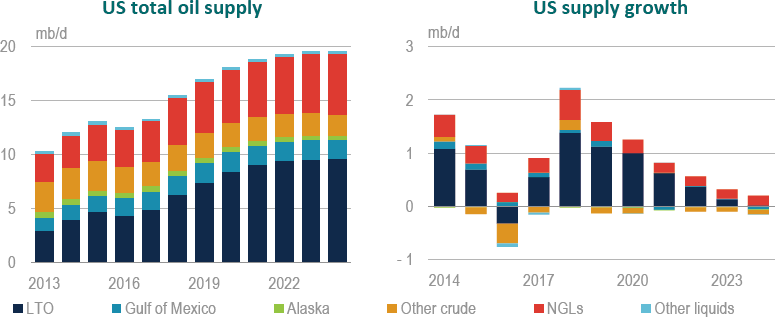

Global oil markets are going through a period of extraordinary change, with long-lasting implications on energy security and market balances throughout the IEA forecast period to 2024. The United States is increasingly leading the expansion in global oil supplies, and accounts for 70% of the total increase in global capacity to 2024, adding a total of 4 mb/d. This follows spectacular growth of 2.2 mb/d in 2018. Significant growth is also seen among other non-OPEC producers, including Brazil, Norway, and Guyana.

Iraq—the world’s third-largest source of new supply—will drive growth within OPEC to 2024, compensating for steep losses from Iran and Venezuela. However, OPEC’C effective production capacity still falls by 0.4 mb/d by 2024. The implications of these developments on energy security are significant and could have lasting consequences.

Dr Birol, the IEA’s Executive Director, said:

These are extraordinary times for the oil industry as geopolitics become a bigger factor in the markets and the global economy is slowing down. Everywhere we look, new actors are emerging and past certainties are fading. This is the case in both the upstream and the downstream sector. And it’s particularly true for the United States, by far the stand-out champion of global supply growth.

The outlook for US oil supply to 2024 is by no means certain, however. Future price levels, investment strategies, infrastructure capacity, the size of recoverable resources and technological advances will all play a part in determining the pace of growth. A 30% crude oil price increase in 2018 compared with 2017 led to more upstream spending than initially budgeted. At roughly $54 billion, exploration and production investment for a selection of 23 large and midsize independents was nearly $6 billion above company guidance and 23% above 2017 levels. Even though current capex guidance suggests US spending by this group of companies could drop by 6% this year, and the number of rigs have been falling, production is likely to grow strongly given the momentum from existing production wells. However, in the following years, US shale activity and light tight oil (LTO) production growth is expected to slow markedly.

(Source: IEA Oil 2019)

Without a material increase in spending, growth will slow as an increasing number of new wells are needed to offset the steep decline from the existing production base. Tight oil wells decline very rapidly after completion, often by as much as 70% within the first year. Given the rapid rise in activity over the course of 2018, the number of wells needed to offset declines rose to 900 per month at the start of 2019, compared with 650 a year earlier. Even with continued innovation, many of the most productive areas in the United States are expected to show signs of depletion by the mid-2020s, given the current recoverable resource potential.

Globally, in the longer term, security of oil supply depends on upstream investment in existing conventional oil projects. Preliminary investment plans by major international oil companies indicate that upstream investment is set to rise in 2019 for the third straight year. For the first time since the 2015 downturn, investment in conventional assets could increase faster than for the shale industry.

In the downstream sector, product markets are on the eve of one of the biggest shakeups ever, with the implementation of the IMO rules that reduce the maximum allowable sulfur content in bunker fuels from 2020. Although the shipping and refining industries have had several years notice, there have been fears of shortfalls when the rules come into effect.

The IEA’s updated analysis, however, shows that industry players are in a strong position to comply in the medium term. As for the first year, the situation will be tight. Prices for gasoil could rise as demand from the marine sector increases. The industry is adjusting, with the largest incremental volumes coming from the United States, the Middle East, and China.

Source: IEA Oil 2019